Cents and sensibility: Personal finance classes becoming bigger part of high school, college education

When Natalie King decided to major in communication disorders at Southeast Missouri State University, she considered the prospects for jobs after graduation. King, a sophomore, said more of her peers are thinking more about majoring in a subject that will produce a job, an effect of the economic downturn...

When Natalie King decided to major in communication disorders at Southeast Missouri State University, she considered the prospects for jobs after graduation.

King, a sophomore, said more of her peers are thinking more about majoring in a subject that will produce a job, an effect of the economic downturn.

"When they do decide their major, they think about it more," she said.

As student loan default rates increase, state officials say money management education should be another consideration for college students. The most recent numbers from the U.S. Department of Education during fiscal year 2007 reflect a 6 percent default rate for Missouri, up from 4.3 percent the previous year. Nationally, the default rate was 6.7 percent, up from 5.2 percent.

Although high school classes covered basic skills like writing checks, college provided little financial training, King said. Once at Southeast, she said, she started to realized the importance of spending money on essentials such as gas and food.

"That was the biggest shock," she said. "I couldn't buy clothes."

A new policy went into effect this year requiring Missouri high school students graduate with a half-unit course in personal finance.

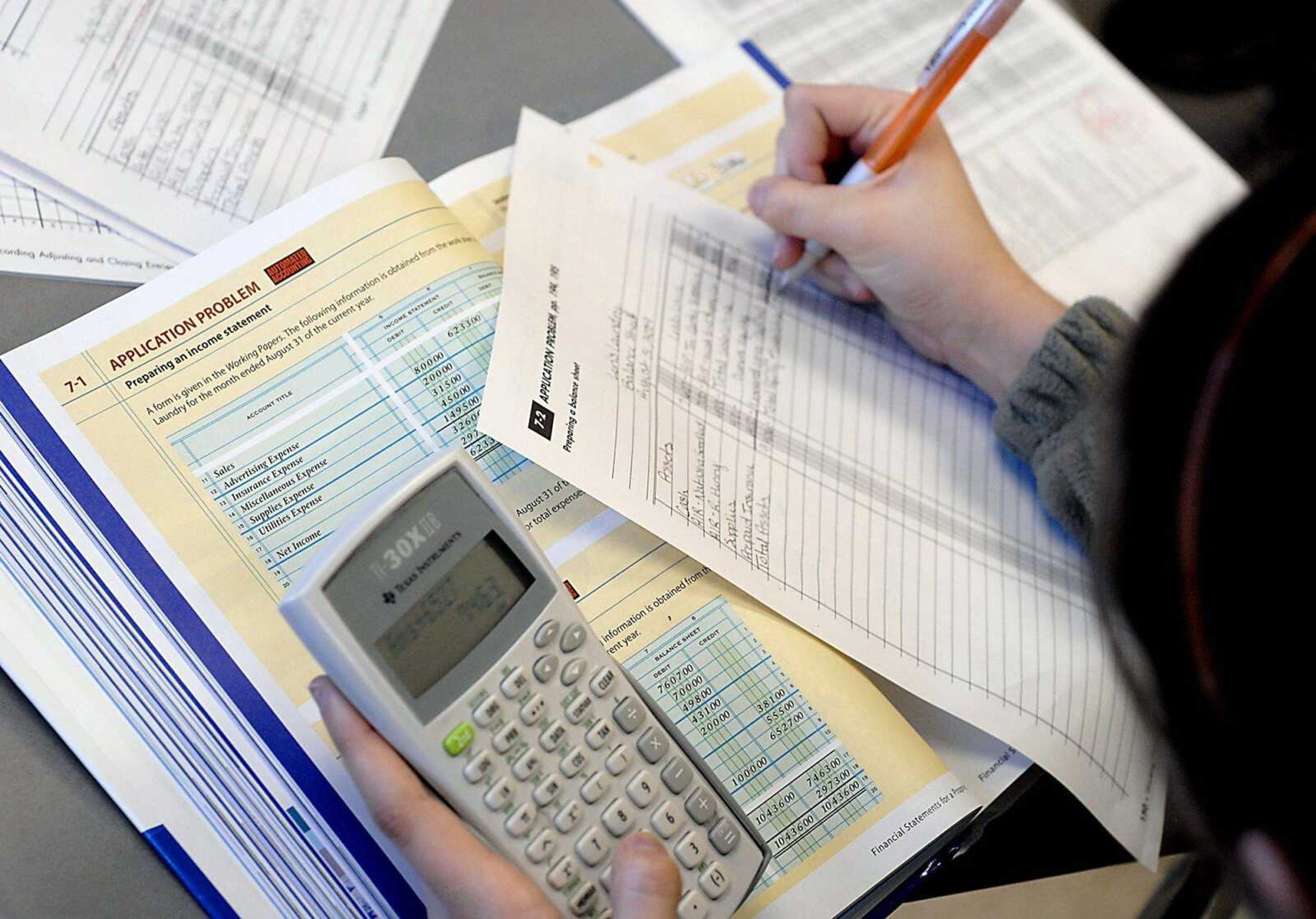

The class has been a requirement at Cape Girardeau Central High School for years, said Patty Wamble, a business teacher. Seniors take the class, and learning to create a budget is one of the most emphasized lessons, she said.

"I think they're at the right mindset when they're a senior," she said.

She said she has students bring in credit card offers so they can analyze the terms of agreement. Learning how to manage credit has become another focus of the class recently, she said. Students often apply for too many credit cards or do not keep track of their debit spending.

"I keep telling them, 'Guys, you can't keep relying on the quick balance,'" she said, referring to ATMs.

Marilyn Landrum, a student assistance associate with the Missouri Department of Higher Education, said high schools are encouraging more financial literacy. Landrum, who works with financial aid officers and college students on financial literacy and loan default prevention. She said she is getting more requests from high schools to do presentations on the topics.

She said colleges should also require personal finance courses during the first semester.

"I think that needs to be carried through the college years as well," she said, referring to finance classes.

Regarding student loans, she suggests students evaluate the amount borrowed.

"Just because they're eligible for X amount of dollars doesn't mean they need that much," she said.

At Southeast, the loan default rate went from 3.6 percent in fiscal year 2006 to 5.3 percent in 2007. The numbers reflect students who participated in the Federal Family Education Loan Program.

The university has been expanding its financial literacy program to meet federal requirements. Starting in the spring, the university will offer financial literacy clinics, said Trent Ball, associate dean of students. The clinics, which will be taught by staff and graduate assistants, will cover topics like budgeting, savings, credit and retirement.

During the past year, he said, the focus of programs expanded from financial aid to financial literacy, which includes broader concepts like budgeting and credit management.

He said the university is also adding an academic component to the program. Students who drop out or do not keep up with their studies could encounter trouble with their student loans, he said.

"It's a dual conversation," he said. "Here's how you stay eligible and here's how you stay responsible in your borrowing."

Joe Graves, a junior in history, said he was careful about spending his student loan money.

"I'm not blowing that extra money," he said. "I'm putting it in a savings account."

Based on the realities of the economy, he said, he realizes that getting a job out of college is not guaranteed. He received training in technical support as a backup plan if he cannot find a teaching job right away.

Although he did not receiving much training on budgeting and finance, he learned the importance of being responsible early, he said. When he started college he said he signed up for one credit card and kept track of his spending.

"It was one of those sink-or-swim type things," Graves said.

abusch@semissourian.com

388-3627

Connect with the Southeast Missourian Newsroom:

For corrections to this story or other insights for the editor, click here. To submit a letter to the editor, click here. To learn about the Southeast Missourian’s AI Policy, click here.