Local banker weighs in on Fed interest rate cut

Local banker Adrian Breen discusses the impact of the Federal Reserve's recent interest rate cut, the first in four years, and its potential effects on mortgages, consumer loans, and savings rates.

The Federal Reserve cut interest rates by half a percent on Wednesday, Sept. 18, the first such reduction in four years. Interest rates fell from a 23-year high of 5.25% to 5.5% to a lower 4.75% to 5%.

“The 50 (basis point) cut signals the Fed’s concerns with the economy and unemployment. This is good news in the short-term if mortgage rates and consumer lending rates follow suit. This could also signal the beginning of additional rate cuts following each Fed meeting through the end of the year if inflation and unemployment remain stable or continue to improve,” said Adrian Breen, president and chief executive officer of The Bank of Missouri.

Breen said the decision would likely lead to decreased mortgage and money market rates, so consumers should prepare their finance decisions accordingly.

“Variable rate consumer loans — credit cards, home equity, adjustable rate mortgages, etc. — will follow suit. This typically also means 30-year mortgage rates may also drop. For savers, CD rates and indexed money market rates will also begin to drop,” he said.

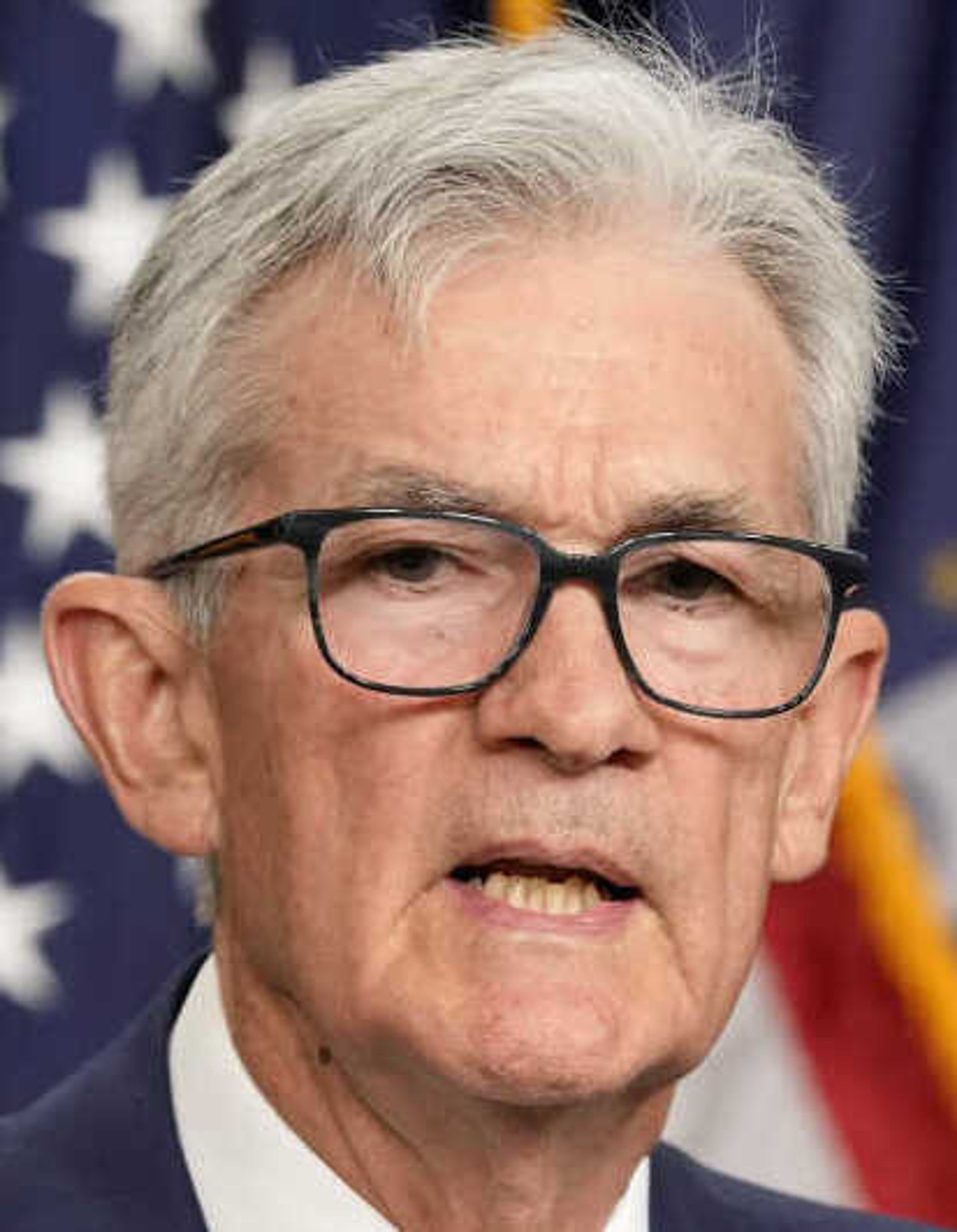

Federal Reserve Chair Jerome Powell said the move was based partly on the Fed’s confidence that inflation would reach policymakers’ goal of a 2% annual rate in the near future. He said he did not see any red flags signaling economic downturn.

Do you want more business news? Check out B Magazine, and the B Magazine email newsletter. Go to www.semissourian.com/newsletters to find out more.

Connect with the Southeast Missourian Newsroom:

For corrections to this story or other insights for the editor, click here. To submit a letter to the editor, click here. To learn about the Southeast Missourian’s AI Policy, click here.