In the world of banking, bigger is not always better. Just ask the depositors in Southeast Missouri.

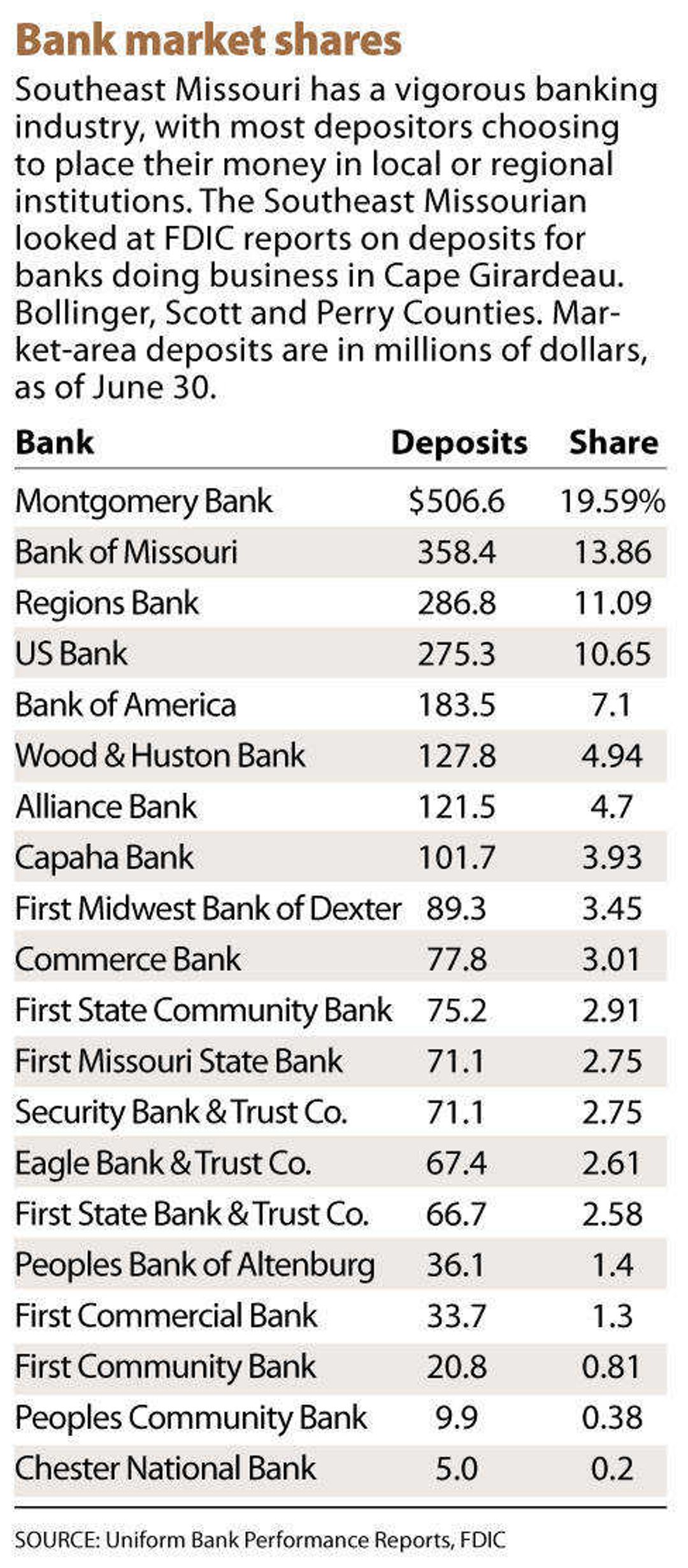

As of June 30, more than 68 percent of the almost $2.6 billion deposited in the 20 banks doing business in Cape Girardeau, Scott, Perry and Bollinger counties was in the hands of smaller banks that do substantial business in the Southeast Missouri market. Major banks, such as Bank of America, Regions Bank and US Bank, are steadily losing market share.

As recently as June 30, 2002, the larger banks held more than half the deposits in the four counties, according to records available online at the Federal Deposit Insurance Corporation.

And while many banks in other parts of the country are reporting falling profits to the FDIC, most of the area's smaller banks reported a healthy increase in net income. Of the 16 area banks, only three reported a drop in profits for the first nine months of the year compared to the results from 2006, and only one, Alliance Bank, reported an operating loss.

Not every part of the picture, however, is rosy. Nine of the 16 local or regional banks doing business in the four counties reported an increase in loan write-offs during the first nine months of the year. That is in line with national trends, as the real estate market has soured and high interest rates, which began falling in September, squeezed margins.

"I think we are going to see some people not making it," said Larry Uelsmann, president of Security Bank & Trust Company, a Scott City-based bank with five branches and $71.1 million in deposits. "The economy is pretty fragile right now, and I am not terribly optimistic. But we will do at least as well as we did last year."

Other bankers echoed Uelsmann's concern about the economy, and not just for the health of area banks. The local economy is starting to lag, said R. David Crader, chief executive officer of the Bank of Missouri based in Perryville, Mo.

"We are not robust," Crader said. "You drive around town and you still see some development going on, but it is not nearly as active as what it has been. But we are still doing pretty well."

During the 1990s, bank consolidations swept both the nation and Missouri. Boatmen's Bank, based in St. Louis, was swallowed in 1997 by Nations Bank, which in turn was merged into Bank of America in 1998.

Bankers at Southeast Missouri banks said the mergers opened the opportunity for them to peel customers away. "For all these holding companies, the management is out of state and the emphasis is on the money centers," Crader said. "We have been able to go in and take business away from them, and that is the only way I can sum it up."

In 1994, Bank of Missouri was the Bank of Perryville, with one banking location and $70.1 million in deposits. Today, Bank of Missouri has 13 locations, $400 million in deposits and holds 13.9 percent of the market.

The key to the growth, Crader said, was finding strong bankers to lead each new branch. "When we made the decision to do our first branch, we looked for someone we could build a bank around," he said. "The key to our growth is our people. We have a very mature staff, and that maturity keeps you from making mistakes."

Both Security Bank & Trust and Bank of Missouri have a long history behind them. Security Bank began in 1905 as the Bank of Edna. Bank of Missouri was formed in 1891.

Alliance Bank, meanwhile, was formed in 1997 and is one of the newcomers to the area market. After several years of steady growth and good profits, it is showing a loss for the year. Bank president and CEO Cord Polen said the loss, pegged at $1.7 million for the first nine months of the year, hasn't hurt the bank's fundamental strength.

Instead, he said, the loss is tied to a decision to set aside $3.3 million in anticipation of losses on a series of loans made to support the purchases of used cars.

"We have been involved in the car-paper business, buying dealer contracts, and that is not what we thought it would be," Polen said. "We decided to take a one-time provision this year, set aside enough to project any losses going forward, get it behind us and get it done."

The sour deals, he said, are part of doing business. "Every bank has cycles where it has issues," he said.

And Alliance won't repeat the mistake, Polen said. "We're getting out of that business."

Alliance has grown quickly, from $16.1 million in deposits its first year and less than 1 percent of the market in its first year to $121.5 million in deposits, 4.7 percent of the total, as of June 30.

The growth, both of Alliance and other smaller banks, can be attributed to both marketing and the necessity of paying higher interest rates to secure the cash needed to make loans. The big national banks, he said, have the luxury of using deposited in one city where loan demand is slack to back lending in areas where demand is high.

The major banks also have access to other financing methods that do not rely on depositors to build the reserves necessary to back loans, Polen said.

All of the local bankers interviewed said they have a conservative approach to lending. They keep a portfolio of loans with three- to five-year life spans and sell long-term debt, such as 30-year mortgages, on secondary markets. The first part of that strategy, they said, leaves them holding quality debt loaned on good security such as land or buildings. The second part of the strategy returns money to their coffers for continued lending while disposing of debt instruments that could become losers in the event of a substantial increase in interest rates or inflation.

Area banks have recognized that one key to growth is online banking and the placement of automatic teller machines around the region. Polen said that Alliance bank will be focusing on those two areas rather than looking for additional banking locations in the next few years.

And Security Bank has begun offering online services, Uelsmann said, but recognizes that its customer base also wants traditional service. "All those services are great and we are now getting to that point," Uelsmann said. "But it is nice to find a face you know that you can talk to."

rkeller@semissourian.com, 335-6611, extension 126

Connect with the Southeast Missourian Newsroom:

For corrections to this story or other insights for the editor, click here. To submit a letter to the editor, click here. To learn about the Southeast Missourian’s AI Policy, click here.