Shoppers fixated with discounts pose big worry for stores

NEW YORK -- Shoppers who became addicted to sales during the last recession have more tools than ever to cross-check prices and find bargains, creating a race to the bottom -- particularly on clothes. While retailers are trying to offer more exclusive products and improve the experience shoppers have in stores, online leader Amazon is expanding quickly into apparel, creating more discounting wars. Off-price stores and new discount chains keep the pressure on...

NEW YORK -- Shoppers who became addicted to sales during the last recession have more tools than ever to cross-check prices and find bargains, creating a race to the bottom -- particularly on clothes.

While retailers are trying to offer more exclusive products and improve the experience shoppers have in stores, online leader Amazon is expanding quickly into apparel, creating more discounting wars. Off-price stores and new discount chains keep the pressure on.

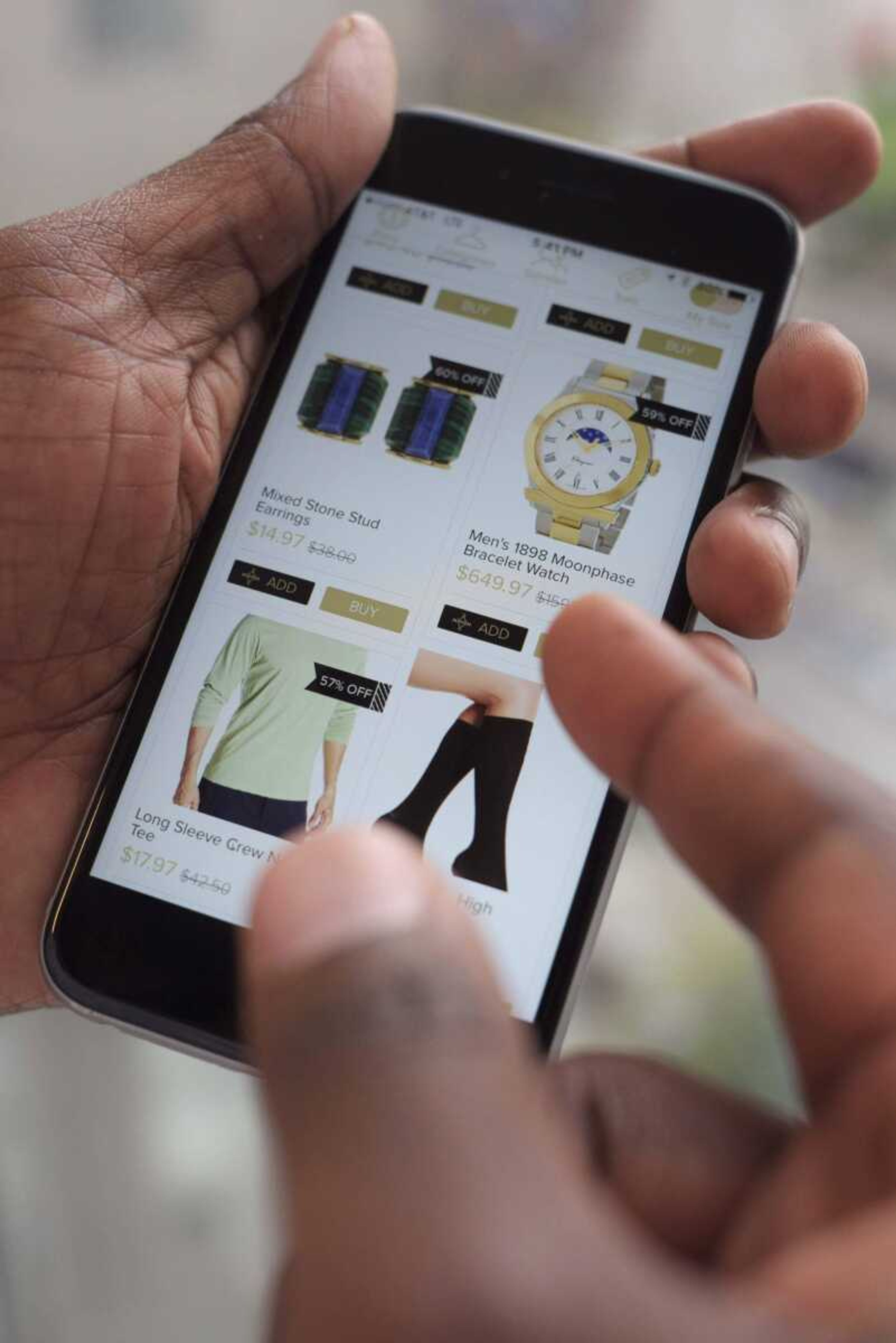

"There is not a lot that I would pay full price for," said Sara Scoggins, a 30-year-old Los Angeles resident who uses apps such as Hafta Have for scanning items and tracking deals and Honey for coupons and promo codes. "There is always a deal. You are a sucker not to get a deal."

The bargain-hunting started in earnest during the recession, when stores plied shoppers with discounts upon discounts to rid themselves of mounds of merchandise after consumer spending tanked.

But even as the economy has perked up, Americans haven't let go of the search for deals.

"We've conditioned consumers, especially coming out of the recession, for promotions and discounting," said Jack Kleinhenz, chief economist at the National Retail Federation trade group.

Shoppers have time and technology on their side. A growing number of apps, websites and browser extensions will search for shipping deals, sales and coupons. And for some shoppers, there's a thrill in outwitting the stores.

Marc Phillips, 26, who works in digital strategies and lives in Manhattan, said he mostly buys clothes at the end of the season and shops at outlets such as Nordstrom Rack.

"I have found some nice deals, like nice designer names," he said. "I consider myself brand-savvy and price-savvy. I understand the types of tricks that stores play."

The cycle feeds itself. People got used to getting great deals, retailers who tried to raise prices saw sales suffer, and shoppers got more bargains.

Moreover, as shoppers gravitate toward services or experiences, demand for items such as clothing has waned -- meaning stores have a harder time raising prices.

Department-store and mall-based clothing retailers have wrestled with the biggest challenges. Even luxury names such as Michael Kors and Ralph Lauren have struggled to get shoppers to buy without discounts. And experts expect the discounting to increase as Amazon becomes more aggressive in clothing sales.

Amazon has made a big push to expand its offerings under private labels such as Lark & Ro, designed to be as stylish as recognizable national brands, so shoppers looking for a skirt or pants automatically are shown that brand compared to a well-known label.

A Lark & Ro skirt could be 50 percent below a similar item from a national brand, said Michelle Ai, manager of marketing at Boomerang Commerce, a startup that helps retailers use data to make price adjustments.

Amazon is poised to surpass Macy's this year as the largest U.S. clothing seller, according to Cowen & Co. analysts. They forecast Amazon's share of the U.S. clothing market will increase from 6.6 percent last year to 16.2 percent by 2021 as it gains more Prime members and increases its clothing selection.

In the meantime, U.S. retailers are facing new competition from low-priced international rivals, including the Primark chain, has started opening stores in the Eastern U.S. It offers jeans as low as $7 and tops for $4.

This means retailers have less ability to raise prices now than during the recession, based on an analysis of government data, said Michael P. Niemira, chief economist at The Retail Economist LLC.

Lyst, an online fashion platform, said 30 percent of orders on the site last year included a discount, up from 23 percent in 2014.

And First Insight, which helps retailers price new items, said its tests have found about 8 percent of products over the past three quarters could sell for full price or higher.

That's down from the 11 percent average over the last several years.

Even that drop "has a significant impact to the industry," said Greg Petro, president and CEO of First Insight.

So is there anything stores can do to convince people their items are worth full price?

Kleinhenz said stores need to differentiate their products to give people more incentive to buy without sales.

J.C. Penney, which has called its previous level of discounts "unhealthy," plans to use a more data-driven approach to pricing to manage discounting better.

Historically, Penney's decisions on pricing and promotions had been made more instinctively and with few analytics.

Ai, meanwhile, said retailers such as Macy's need to test a lower range of prices online with their store-label products, which could drive more shoppers to their site.

In the end, it's a shopper's choice whether to wait or jump.

Leor Reef, 24, who works in public relations and is based in Chicago, said he learned about frugality from his parents, who always found good deals.

He shops mostly online, uses browser extension price-trackers such as camelcamel.com and tends to buy only when he sees a good deal.

"It does put me in more in control as a consumer," he said. "As long as I am not in a rush, I can hunt around and use my tools to find the best price."

The downside? Reef wanted the popular Wilson Evolution basketball and waited a month for the price to go down 15 percent, but then it sold out -- and he was left empty-handed.

Connect with the Southeast Missourian Newsroom:

For corrections to this story or other insights for the editor, click here. To submit a letter to the editor, click here. To learn about the Southeast Missourian’s AI Policy, click here.