Stock market today: Wall Street ticks higher as more earnings come in ahead of Fed rate decision

Wall Street pointed toward modest gains early Thursday after storming to records a day earlier on former President Donald Trump's presidential election victory.

Wall Street pointed toward modest gains early Thursday after storming to records a day earlier on former President Donald Trump's presidential election victory.

Futures for the S&P 500 rose 0.3% before the bell and the Dow Jones Industrial Average ticked up 0.2%

Investors pored over a deluge of mixed corporate earnings reports as they prepare to turn their attention to the Federal Reserve’s decision on interest rates, due later in the day.

Lyft jumped close to 24% in extended trading overnight after the ride-hailing app breezed past Wall Street's sales and profit expectations and raised its forecast for the fourth quarter and full year.

Chipmaker Qualcomm climbed 7% after beat analysts' forecasts after its third-quarter net income nearly doubled from the same period a year ago. Arm Holdings also beat Wall Street targets, but the British chipmaker's guidance disappointed investors and its shares fell 6.5% before the bell.

Match Group tumbled 14% after the dating app brand missed revenue targets as its most popular app, Tinder, continued to underperform.

In Europe at midday, Germany’s DAX gained 0.8% the CAC 40 in Paris was nearly unchanged.

Britain's FTSE 100 edged down 0.2% after the Bank of England cut its main interest rate by a quarter of a percentage point to 4.75% on Thursday. The latest cut comes afte r inflation in the U.K. fell to an annual rate of 1.7%, its lowest level since April 2021.

Inflation in the U.S. has retreated on a similar track, and the broad expectation is that the Federal Reserve will cut its rate by another quarter-point later Thursday.

Much of Wall Street’s run to records this year was built on expectations for cuts to interest rates by the Federal Reserve, as inflation has headed back down to its 2% target. Easier interest rates help boost the economy, but they can also give inflation more fuel.

In Asia, Japan's Nikkei 225 fell 0.3% to 39,381.41, reflecting worries over the potential for a revival of trade tensions under a Trump administration.

“I think everybody’s going to be worried about Trump's tariffs because that’s one of the things in his playbook. And so we’ll have to see how things develop in the early stages of his presidency this time," said Neil Newman, head of strategy for Astris Advisory Japan.

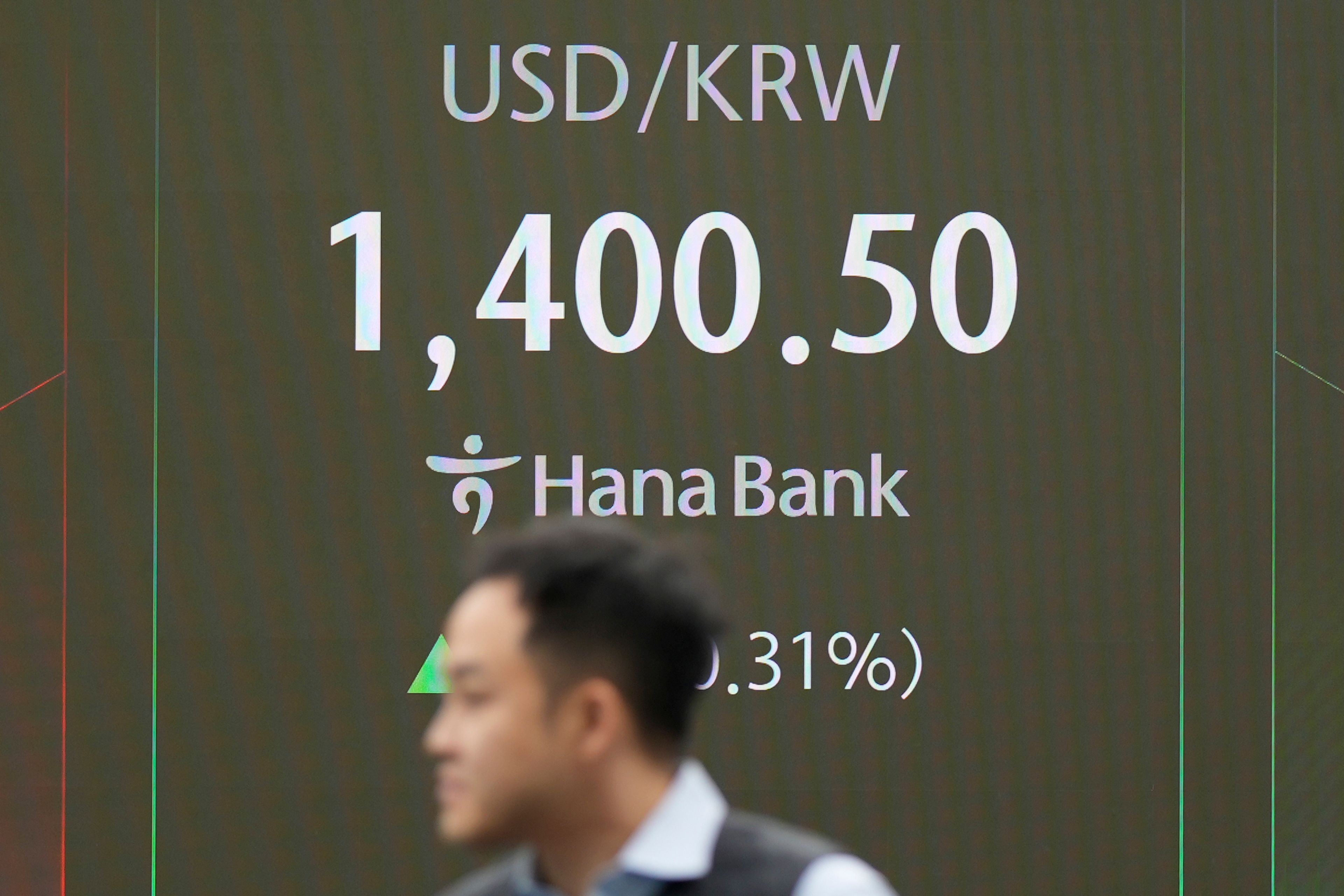

South Korea's Kospi finished nearly flat, at 2,564.63. Australia's S&P/ASX 200 rose 0.3% to 8,226.30.

Chinese shares rallied after the government reported that exports jumped nearly 13% in October over a year earlier, the fastest pace in more than two years and far outpacing the 2.4% increase in September.

Hong Kong's Hang Seng gained 2% to 20,953.34. The Shanghai Composite index was up 2.6% at 3,470.66.

Trump has promised to slap blanket 60% tariffs on all Chinese imports, raising them still more if Beijing makes a move to invade the self-governing island of Taiwan.

Investors are adding to bets built earlier on what the higher tariffs, lower tax rates and lighter regulation that Trump favors will mean. Higher tariffs on imports from China would add to the burdens Beijing is facing as it struggles to revive slowing growth in the world's second-largest economy.

But the impact may be less drastic than feared, Zichun Huang of Capital Economics said in a report.

“We expect shipments to stay strong in the coming months –- any drag from potential Trump tariffs may not materialize until the second half of next year," Huang said.

Still, higher tariffs on imports from China, Mexico and other countries would raise the risk of trade wars and other disruptions to the global economy.

Trump's win raised expectations that Beijing may ramp up its spending and other stimulus to counter such trends. The Standing Committee of China's legislature is meeting this week and is expected to announce further measures by Friday.

Francis Lun, CEO of Geo Securities, said domestic issues were a greater concern than tariffs. "People want the government to spend some money to boost the economy, instead of looking outward,” he said.

In other dealings early Thursday, the U.S. dollar weakened against the Japanese yen, slipping to 153.86 yen from 154.62 yen. The euro rose to $1.0768 from $1.0730.

U.S. benchmark crude oil shed 75 cents to $70.94 per barrel. Brent crude, the international standard, lost 58 cents to $74.34.

The price of bitcoin settled in around $75,048 after hitting an all-time high above $76,480 on Wednesday. Trump has pledged to make the country “the crypto capital of the planet” and create a “strategic reserve” of bitcoin.

Connect with the Southeast Missourian Newsroom:

For corrections to this story or other insights for the editor, click here. To submit a letter to the editor, click here. To learn about the Southeast Missourian’s AI Policy, click here.