Up for sale: Area foreclosures saturate housing market

I n a home on the north side of Cape Girardeau, pencil marks on a closet doorway chart the growth of a child since 1999. In the kitchen, the stove is missing. And in the living room, deep impressions in the carpet recall an entertainment center now gone. The walls tell tales as well -- someone painted around the entertainment center, leaving an outline so clear it is as if it left a shadow behind...

I n a home on the north side of Cape Girardeau, pencil marks on a closet doorway chart the growth of a child since 1999.

In the kitchen, the stove is missing.

And in the living room, deep impressions in the carpet recall an entertainment center now gone. The walls tell tales as well -- someone painted around the entertainment center, leaving an outline so clear it is as if it left a shadow behind.

The home is just one of 129 Cape Girardeau County properties taken from their owners through foreclosure in the first 11 months of the year. That number is 37 percent higher than the total for all of 2006.

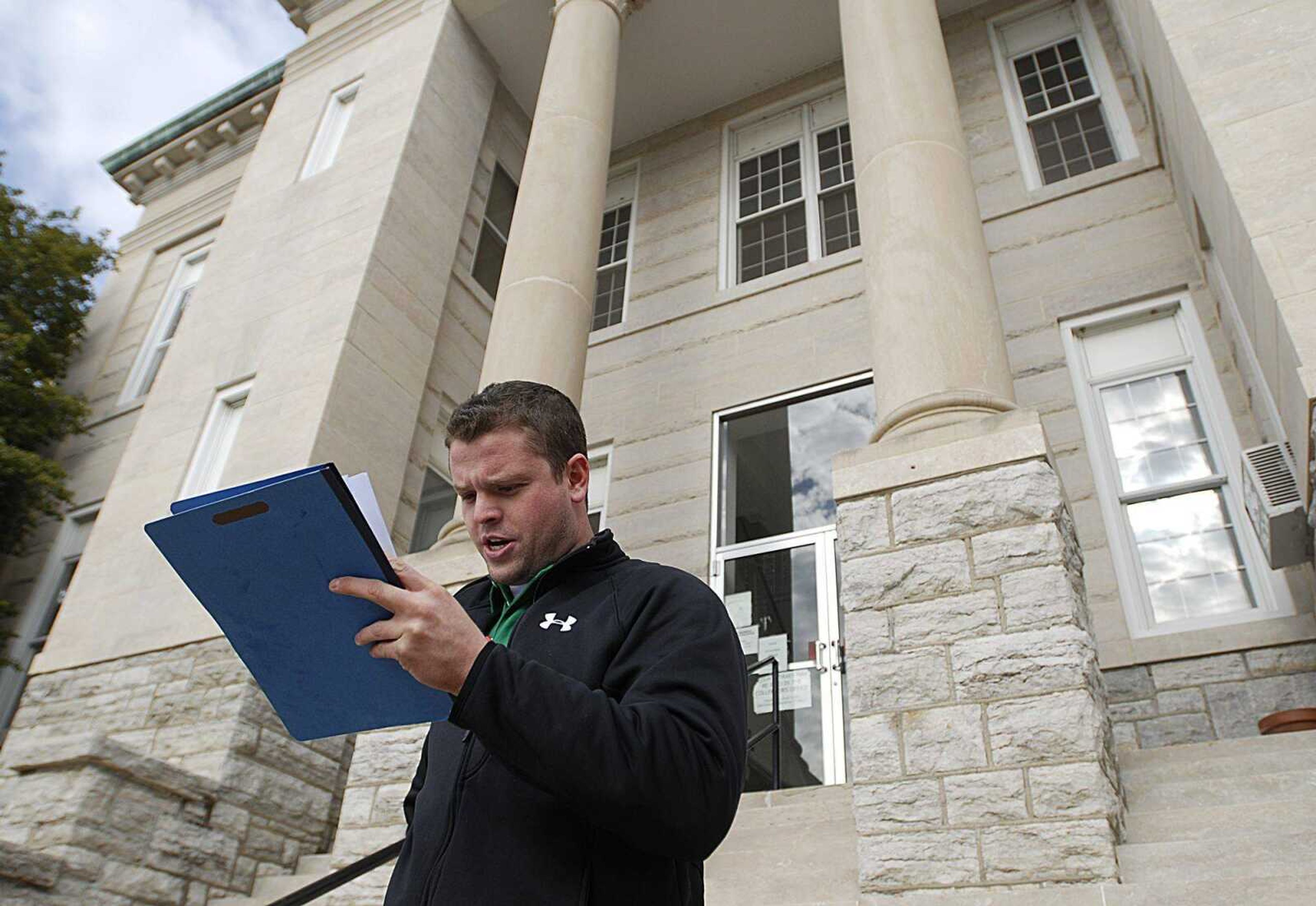

And more foreclosures are coming. On Thursday, a representative of the St. Louis law firm of Milsap & Singer P.C. sold three properties in default on their mortgages on the steps of the Cape Girardeau County Courthouse in Jackson. There were no bidders except the mortgage holders.

And in the past month, the Southeast Missourian has published legal notices of foreclosure actions against a total of 24 properties. The defaulted loans on 17 of those properties were written since Jan. 1, 2004, including one written as recently as March.

President Bush last week announced a plan to help up to 1.2 million homeowners through an interest rate freeze or help refinancing mortgages into fixed-rate, government-backed FHA loans. But the help is coming too late for many.

"I am still evaluating it," said Tom Meyer of Exit Realty, who handles the resale of foreclosed homes for several lenders. "Exactly what it means, time will tell."

Root of the problem

There are numerous reasons homes go into foreclosure -- medical bills and loss of a job can lead to default -- but real estate agent Denise Stover of Century 21 Heartland in Jackson laid most of the blame on an irresponsible lending market. Stover works with several lenders to resell homes after they have been seized.

Too many lenders, she said, chose to sign buyers up for adjustable rate loans or interest-only mortgages that became unaffordable as rates rose.

"Some lenders -- not all, but some -- were doing anything they could to get them into a home," Stover said. "They didn't care, and now there are a lot of properties where people owe more on them than they are worth." The lenders "are taking the money and not looking at what they are doing to people six months or a year later."

Foreclosures, it seems, are the only part of the real estate market where there's lots of action.

Real estate agents report lengthy waits for a sale -- the average time on the market nearing four months.

Builders are constructing fewer homes -- only 77 building permits for single-family homes have been issued in Cape Girardeau this year, down from 101 in 2006 and 128 in 2005.

And developers, who recorded 59 subdivisions with 793 lots in 2005, have recorded 50 subdivisions so far this year, but only 369 lots.

"There are a lot of homes on the market right now, the market is really saturated," Stover said. "But buyers look at it the wrong way. A lot of people look at it like they can buy for 20 or 30 percent less than the listed price. But sellers can't do that."

While in a normal market, homes priced properly will sell in 60 to 90 days, Stover said the current average marketing time is approaching six months.

Signs of recovery

But she and other real estate agents are seeing some signs of recovery. Stover said she has been busier in the last month than she has all year -- an unusual situation in colder months.

And Sheila King, president of the Cape Girardeau Board of Realtors, said two recent interest rate cuts by the Federal Reserve are making purchases attractive.

"These past couple of weeks I have been really busy," King said. "What is happening in California is not happening in Southeast Missouri. It is busy and the interest rates are still good."

But lenders are also more wary of who they are financing, realtors said. "Money is definitely a lot tighter," Stover said. "It is very hard for anyone to get 100 percent financing any more. It depends on credit rating and things like that, and I'm not saying people can't do it anywhere, but it is not nearly as easy as it was two years ago."

From notice of default to putting a foreclosed home on the market takes several steps. In Missouri, the lender records a mortgage with a Deed of Trust, which can be invoked to take possession of a property. After notifying the borrower, the mortgage holder conducts a trustees' sale, like the one Thursday in Jackson.

The next step is to get the former owner out of the home. Both Stover and Meyer said they often succeed by offering a modest payment -- usually $500 to $1,000 -- to help the former owner make a deposit on a rental. But the payment is contingent upon leaving a moderately clean home and turning the keys over at a designated time.

Ready for sale

The home in north Cape Girardeau, to Meyer's eyes, is ready for sale. Despite needing a thorough cleaning, it is in relatively good shape compared to some he's seen, Meyer said.

"I have found them full of trash and garbage, with basements full of junk," Meyer said. "I've seen them at both extremes."

When an incentive won't work, formal eviction can sometimes be required, Meyer said.

The first approach can be crucial, he said. Losing a home is an emotional event, and with underlying reasons creating other stress, telling a family it is time to move can be a trying experience, he said.

"I always make sure I have someone with me," Meyer said. "You never know who might have taken up residence when you go in. You never know what you are going to find."

And sometimes, he said, the remains are cause for concern. "Sometimes you go to the houses and see things that bother you," he said. "One thing that really bothers me is when they leave behind baby bottles thrown everywhere and the home is filthy. It makes me wonder, where did these people go and where are these kids?"

rkeller@semissourian.com

335-6611, extension 126

Connect with the Southeast Missourian Newsroom:

For corrections to this story or other insights for the editor, click here. To submit a letter to the editor, click here. To learn about the Southeast Missourian’s AI Policy, click here.