BBB director: Check fraud scams are on the rise

Check fraud and related scams are on the rise, according to recent research by the Better Business Bureau, said regional director of the Cape Girardeau BBB, Whitney Quick, during a news conference Wednesday. Counterfeit business checks, cashier's checks and money orders are now used in many of the most common frauds people encounter on a regular basis, according to BBB research, Quick said, adding complaints registered about fake checks have doubled over the last three years...

Check fraud and related scams are on the rise, according to recent research by the Better Business Bureau, said regional director of the Cape Girardeau BBB, Whitney Quick, during a news conference Wednesday.

Counterfeit business checks, cashier's checks and money orders are now used in many of the most common frauds people encounter on a regular basis, according to BBB research, Quick said, adding complaints registered about fake checks have doubled over the last three years.

In 2017, the total number of victims reported to regulatory agencies was about 33,000, but most victims don't complain, so the actual number could be much higher, Quick said.

Quick gave an example of a check scam: If a person posts a used car for sale online, a buyer may contact them, agree to the price, and send a cashier's check to cover the price and cost of shipping the car. The seller deposits the check, then the buyer asks the seller to go to Western Union and send some money to cover expenses. Since the check is deposited, the seller thinks the transaction is covered, only to find out several days later that that was not the case.

"Just having the money credited to your bank account does not mean that the check is good," Quick said.

Quick said many victims of this kind of fraud are small businesses, often photographers or lawyers.

Several perpetrators are from Nigeria, Quick said, and the system is large and organized. Checks must be stolen and created, victims must be contacted and communicated with, and someone must pick up the money.

Quick said education and law enforcement are key elements in the fight against check fraud.

Banks are training their employees to spot fake checks, she said.

But it is important for members of the public to know cashier's checks and money orders can bounce -- if they're counterfeit, Quick said.

Sgt. Rick Schmidt with the Cape Girardeau police department said the best thing anyone can do when they receive a questionable check is, "Call us. We can do research for you, and we probably have a heads' up from other agencies."

He added, "If it sounds too good to be true, it is."

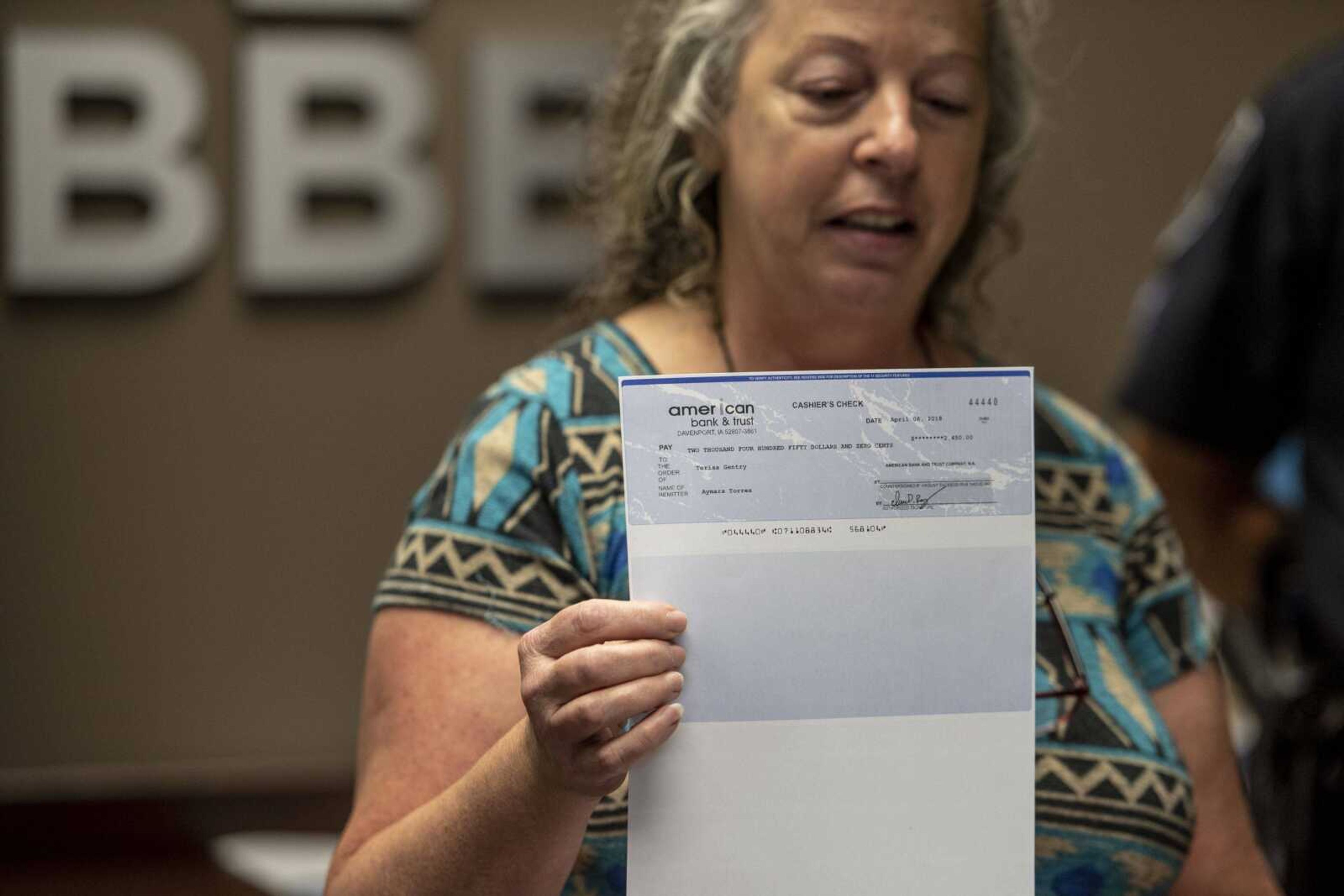

Terisa Gentry gave an account of her brush with check fraud. Gentry looks for part-time work online and saw a job posting for a mystery shopper position. She thought it sounded like fun, so she signed up, and received her first check for $2,400.

Gentry's husband told her he thought it was a scam, so she did some research and found complaints against the company with the same name, and noticed the check was sent to her from an individual, not the company, and was accompanied by a letter asking her to wire money to yet another individual, who was staying in a hotel in Georgia.

"We all want money," Schmidt said. "When you get a lot of money and haven't done anything, that's a clue."

mniederkorn@semissourian.com

(573) 388-3630

Connect with the Southeast Missourian Newsroom:

For corrections to this story or other insights for the editor, click here. To submit a letter to the editor, click here. To learn about the Southeast Missourian’s AI Policy, click here.