First-quarter home sales in Cape County up 18 percent over last year

This spring's homebuying season may signal the recovery real estate agents have been waiting for. The first quarter is typically the slowest of the year for home sales, but this year is off to a strong start. Phones are ringing, attendance at open houses is growing and sales are increasing, local agents said...

This spring's homebuying season may signal the recovery real estate agents have been waiting for.

The first quarter is typically the slowest of the year for home sales, but this year is off to a strong start. Phones are ringing, attendance at open houses is growing and sales are increasing, local agents said.

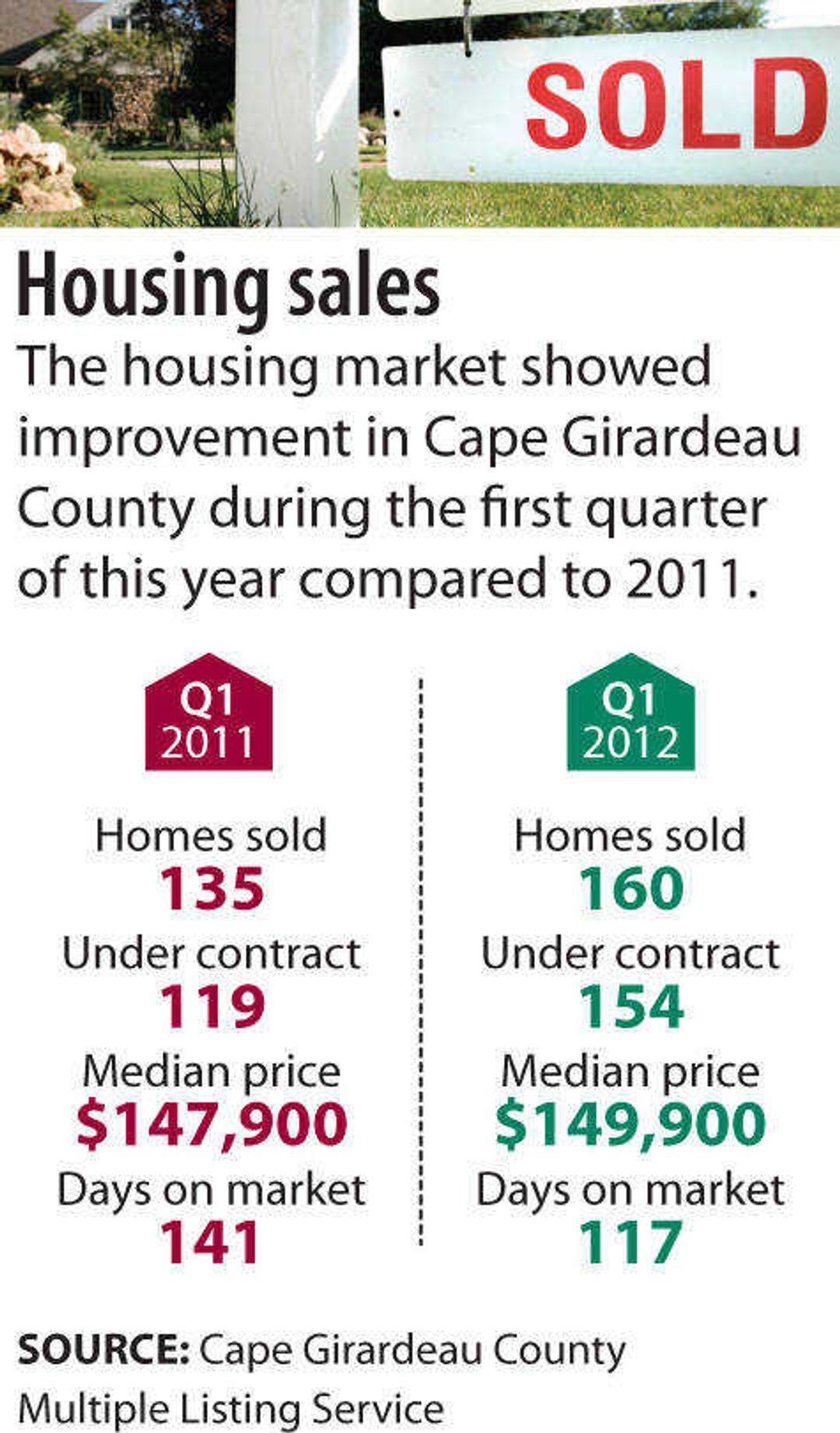

First-quarter home sales in Cape Girardeau County are up 18 percent compared with the same period last year, according to Multiple Listing Service statistics.

With 160 homes sold from January through March, sales are near 2007's record of 185 houses sold in the first quarter.

First-quarter figures in 2009 and 2010, following the recession, were 135 both years.

"The consensus of our executives is buyer confidence is building," said Bill Cole, owner of Realty Executives in Cape Girardeau. Realty Executives saw a 31 percent increase in the dollar volume of contracts written during the first quarter of this year compared to 2011.

Laura Ritter, a real estate agent with Century 21 Ashland in Cape Girardeau, said owning a home is still the American dream.

"Buyers in our area are realizing that values are remaining stable without the big ups and downs experienced in other areas that we often hear about in the national news. With that confidence, they do feel they can move forward," said Ritter, whose own first-quarter sales are up 20 percent from last year.

The unusually warm winter also kicked off the spring homebuying season early, agents said.

"I think they got a little bit of spring fever," said Tom Meyer, owner of Exit Realty/Thomas Meyer Associates in Cape Girardeau.

Nationwide, January and February were the best for sales of previously occupied homes in five years, according to the U.S. Department of Commerce. Sales of previously occupied homes have risen more than 13 percent since July.

Real estate agents also say they're seeing more interest in new construction.

Meyer said he's been approached by both contractors and families interested in subdivision lots.

"This year the trends are going in the right direction," Meyer said. "A lot of it has to do with pent-up buying interest."

Meyer's seeing growing families looking for more square footage, more bedrooms or another bathroom. "We're seeing a lot of buy-ups right now. They're going from their $100,000 house up to $200,000 to $225,000."

Low interest rates, now at around 4 percent for a 30-year fixed-rate mortgage, are making homeownership more affordable for first-time buyers as well.

When gas prices started rising, Erica Wheeler decided buying a house in Cape Girardeau was more affordable than her 60-mile round trip commute to the office.

"Home prices are lower than usual due to the recession, and there were a lot more options available to me in my price range and locations I was looking at," Wheeler said. The home she purchased in January had dropped in price by $15,000 during the nine months it was on the market.

Interest rates were also a factor in her decision to buy, she said.

Kyle and Jenny Schade, who bought their first home in Cape Girardeau last month, were motivated in part by low rates as well.

"Everybody else was telling us how great rates were. We just figured there was no better time really as long as we could afford it," Kyle Schade said.

The couple found a home with everything they wanted at what they felt was a reasonable price, Schade said. The three-bedroom, two-bath home with an unfinished basement gives their family room to grow as they are expecting their first child this fall.

"We wanted to have ownership of something so we could build equity," Jenny Schade said. "We knew we didn't want to rent long term."

It is still a buyer's market, real estate agents say, although they are seeing more offers on the same house. Home prices are ticking up slightly, and the number of days homes are staying on the market is shrinking.

Home prices in the first quarter of this year increased slightly compared to a year ago. On March 31, the median list price was $149,900 compared to $147,900 on the same date in 2011, according to MLS statistics.

"It's a little early in the year to establish a reliable trend," Cole said.

The effect of foreclosures on home prices is still a factor, he said. During 2010 and 2011, about one in every seven homes sold was a foreclosure, which typically sell for less.

The average number of days a house is on the market is now 117 days, down from 141 days last year.

mmiller@semissourian.com

388-3646

Connect with the Southeast Missourian Newsroom:

For corrections to this story or other insights for the editor, click here. To submit a letter to the editor, click here. To learn about the Southeast Missourian’s AI Policy, click here.