NEW YORK -- Cash is passe, say digital mavens. If you really want to pay your friends back for that pizza party, use an app to shoot money to their mobile-phone number -- or their Facebook account.

Such technology-enabled peer-to-peer payments are growing quickly. Forrester Research predicts mobile peer-to-peer payments will hit $17 billion by 2019, growing an average of 26 percent annually.

That compares with expectations of total U.S. mobile payments of $142 billion by that year.

PayPal and its Venmo service have carved out an early lead in the arena, particularly among millennials. Venmo has been growing by leaps and bounds: It processed $2.4 billion in payments in 2014 and almost that much -- $2.1 billion -- in the most recent third quarter alone.

The buzz has grown loud enough that even Apple may join the fray, perhaps as early as next year, according to recent reports. (Apple declined to comment.) But it's not time to throw away your checkbook; peer-to-peer payments still are a sliver of total online spending.

Here's a closer look at your current options for blasting digital dollars to your online acquaintances:

Paypal

How it works: PayPal lets you send money directly to other people via its website or app, much the same way you can use the service for online shopping. It also offers a dedicated site called PayPal.Me, which generates personal links you can send to your deadbeat friends so they can transfer money directly to your PayPal account.

Payment limit: No limit if you've linked your bank account to PayPal, but $10,000 if you're paying via a linked credit card.

Fees: None if you're sending funds from a linked bank account, but there's a 3 percent charge if you use a credit card.

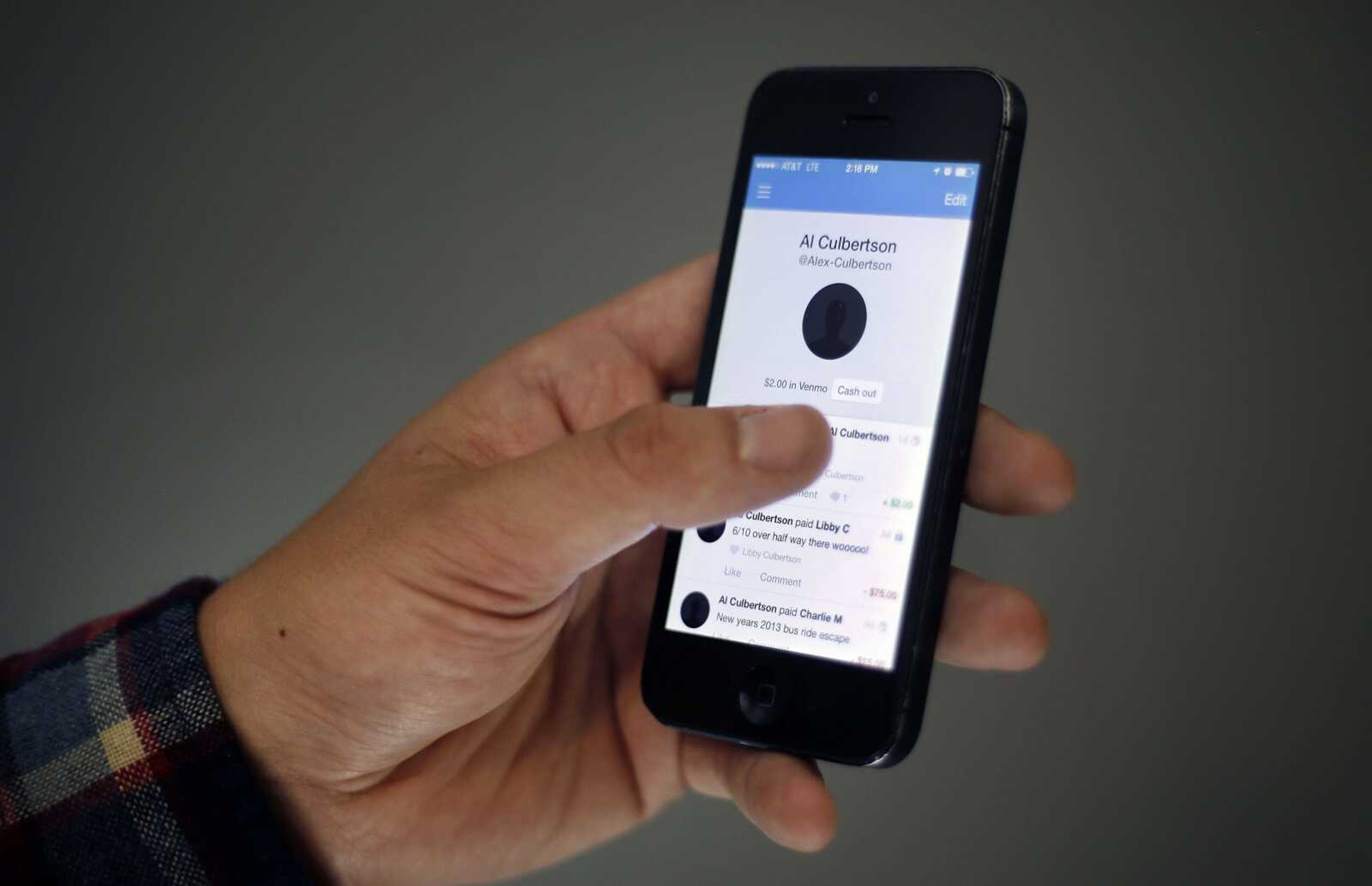

Venmo

How it works: Venmo's app adds a social component to payments. Users sign up via the app and connect to friends who also have signed up. You have to add a description for each payment you send, which -- just like a Facebook post -- you can then choose to make public, restrict to your Venmo network or keep private. Venmo is owned by PayPal.

Payment limit: New users face a rolling weekly limit of $300. Once you confirm your identity by linking your Facebook account or providing other personal information such as part of your Social Security number, the limit goes up to $3,000.

Fees: Free for transactions via bank accounts or debit cards; 3 percent charge per transaction via credit cards.

Square Cash

How it works: Sign up for the Square Cash app or on the Cash.me website and you'll get a personal link called a "$Cashtag" people can click to send you money. Square also has worked with Snapchat and Twitter (whose CEO Jack Dorsey co-founded Square) so you can send money on those networks via "$Cashtags."

Payment limit: An initial $250 spending limit per week. You can verify your identity via the last four digits of your Social Security number or by linking to a Facebook account, which ups the limit to $2,500.

Fees: Free for transactions via a bank account or debit card; 3 percent charge per transaction to link to a credit card.

Facebook payments

How it works: Facebook payments operates via Facebook's Messenger app. To send or receive money, you must add a debit card (U.S. banks only) to your account. To send money, open a chat with a Facebook friend, click on a dollar sign icon and enter the amount you want to send. To receive the money a person has to add his or her debit card to his or her Facebook account.

Payment limit: None

Fees: None

Gmail

How it works: First, you need a Google digital wallet; once you have that, you can send and receive money via Gmail by clicking on the dollar sign icon in the Gmail toolbar. You can either send or request payments; once you've established the amount, you "attach" it to an email message much the way you'd attach a document.

Payment limit: $10,000 per transaction

Fees: None

Popmoney

How it works: Citibank, Bank of America, Wells Fargo and many regional banks offer person-to-person payments via Popmoney. (You also can sign up for the service on your own if you like.) Like other services, it lets you send or request money by way of a person's email or phone number.

Payment limit: $500 per day if you link a debit card; $2,000 per day from a bank account.

Fees: 95 cents per completed transaction, either payment or request. It's free to pick up a payment.

The big banks

How it works: Most major national banks have offered online payment services for years under names such as Chase QuickPay or Bank of America Mobile Pay. The services run through bank websites and apps and let you send money from your bank account via your recipient's email address or phone number.

Payment limit: Varies; typically $1,000 to $3,000 per transaction.

Fees: None

Connect with the Southeast Missourian Newsroom:

For corrections to this story or other insights for the editor, click here. To submit a letter to the editor, click here. To learn about the Southeast Missourian’s AI Policy, click here.