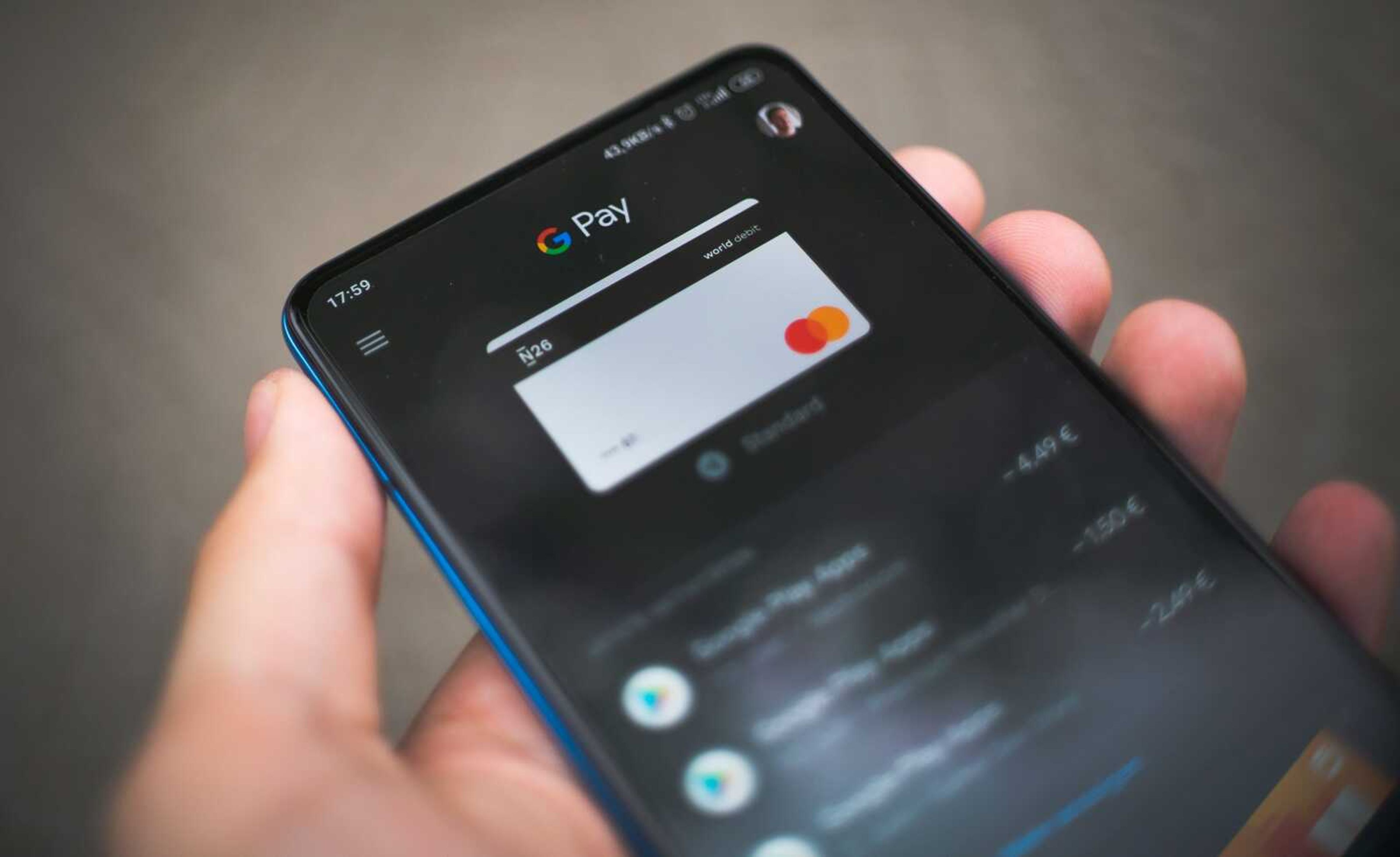

Venmo, PayPal, Cash App under IRS regulation

For the first time, the Internal Revenue Service is now requiring third-party payment apps to report transactions totaling more than $600 in a calendar year to the Internal Revenue Service. The regulation, which took effect Jan. 1, will impact popular consumer apps such as PayPal, Venmo and Cash App...

For the first time, the Internal Revenue Service is now requiring third-party payment apps to report transactions totaling more than $600 in a calendar year to the Internal Revenue Service.

The regulation, which took effect Jan. 1, will impact popular consumer apps such as PayPal, Venmo and Cash App.

The intention, say government regulators, is to ensure small businesses receiving payments through those apps pay their fair share in taxes.

The new tax law was part of the March 2021 American Rescue Plan legislation.

Looking for more business news? Check out B Magazine, and the B Magazine email newsletter. Go to www.semissourian.com/newsletters to find out more.

Connect with the Southeast Missourian Newsroom:

For corrections to this story or other insights for the editor, click here. To submit a letter to the editor, click here. To learn about the Southeast Missourian’s AI Policy, click here.