Sticker shock: Cape Girardeau County personal property tax bills arrive

Bills for 2022 personal property taxes in Cape Girardeau County are up -- in some cases, way up -- thanks to supply chain problems, microchip shortages and high inflation. The office of County Collector Barbara Gholson sent out more than 35,000 statements earlier this month and people have noticed the change...

Bills for 2022 personal property taxes in Cape Girardeau County are up -- in some cases, way up -- thanks to supply chain problems, microchip shortages and high inflation.

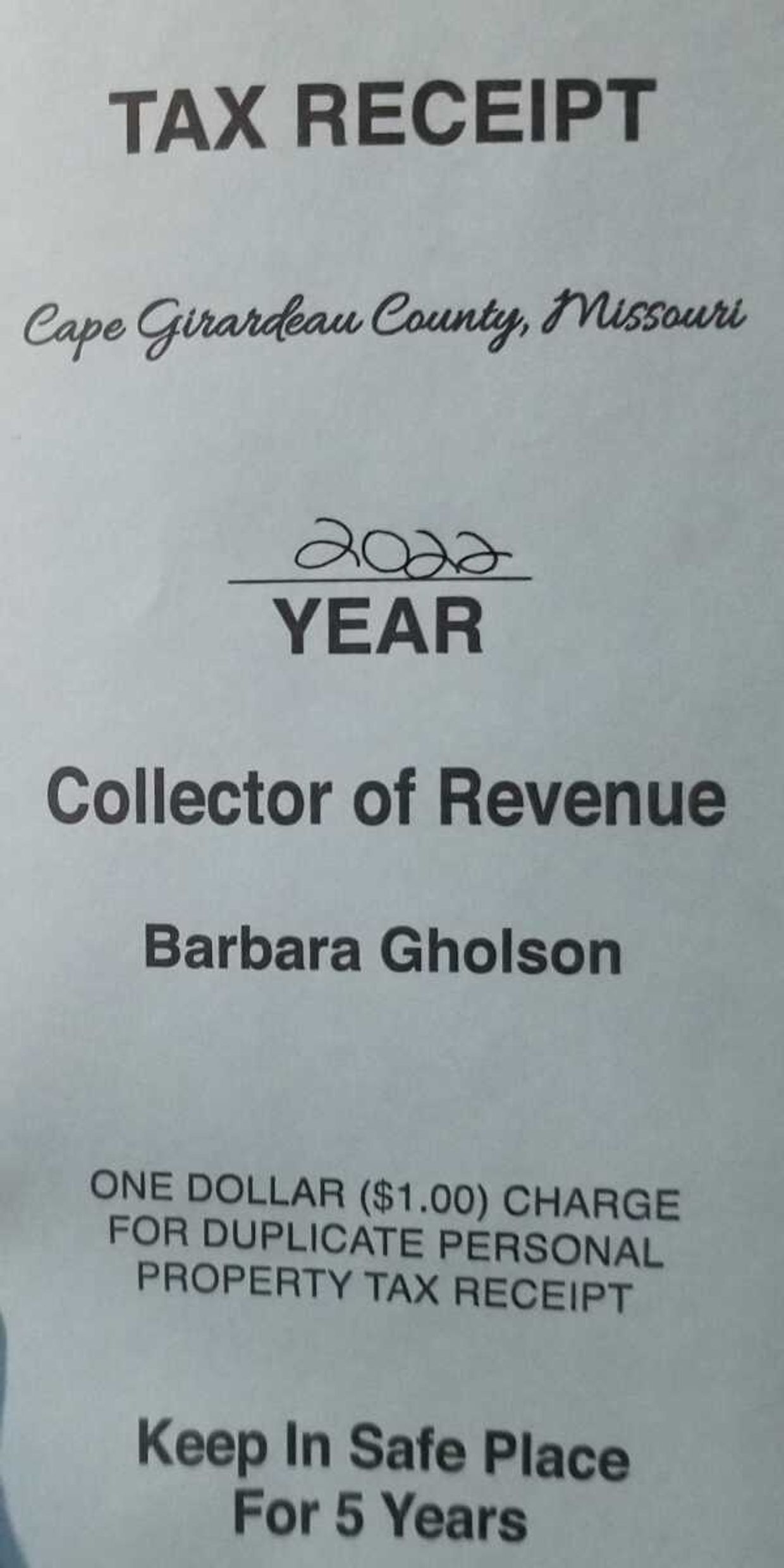

The office of County Collector Barbara Gholson sent out more than 35,000 statements earlier this month and people have noticed the change.

"(People) are not happy their taxes went up, and it's understandable," Gholson said Wednesday, Nov. 23.

"The values of their vehicles have appreciated because county assessors get their values from the National Automobile Dealers Association (NADA)."

An employee in the office of Cape Girardeau County Assessor Bob Adams told the Southeast Missourian a vehicle identification number (VIN) plugged into NADA's system determines the fair market trade-in value on which the tax is based.

While Gholson said she has not calculated the average increase for county residents this year, the St. Louis city assessor's office reported the average personal property tax hike in Missouri's second-largest municipality is about 30%.

Methodology

The soaring bills caused the state's tax commission to issue a Friday, Nov. 18, special advisory directed at collectors and assessors in all of Missouri's 114 counties.

"The methodology requires county assessors to use the trade-in value published in the October (2022) issue of the NADA Official Used Car Guide as the recommended guide for determining the value of motor cehicles. The assessor is not allowed to use a value greater than the average trade-in value without performing a physical inspection of the motor vehicle. In the absence of a listing for a particular motor vehicle in the NADA guide, the assessor must use information or publications which, in the assessor's judgment, will fairly estimate the fair market value of the motor vehicle. Because supply-chain problems, the chip shortage and inflation have driven the values of motor vehicles upward, the NADA guide used to assess vehicles this year reflects those increased values," the advisory stated.

Uses

The largest share of personal property tax revenue is distributed to a resident's local school district, smaller amounts are disbursed to the city of residence, the local public library, the Cape Girardeau County Health Department, senior services, sheltered workshop and mental health board, among other recipients.

Selective

While the majority of U.S. states collect personal property tax, 23 states do not.

Among the eight states contiguous to Missouri, only Illinois and Tennessee have no mechanism for levying the tax.

Outlook

Analysts predict inventory of motor vehicles may not return to pre-pandemic levels until late 2023, and the chip shortage, which has had a dramatic effect on vehicle prices, might not be alleviated until 2024," according to the tax commission advisory.

Gholson said any Cape Girardeau County resident who did not receive either a personal property or real estate tax bill by Thanksgiving should call her office, 573-243-4476.

Taxes are due by December 31.

Connect with the Southeast Missourian Newsroom:

For corrections to this story or other insights for the editor, click here. To submit a letter to the editor, click here. To learn about the Southeast Missourian’s AI Policy, click here.