October's general tax revenue figures are in from the state Department of Revenue, and Cape Girardeau County seems poised for another potentially record-shattering annum.

In 2022, the county's general revenue surpassed $9 million for the first time as $9,198,739.12 flowed into county coffers, an 8.62% increase from 2021.

If this year's tax generation from January through October is a guide, the county should soar above $9 million again in 2023.

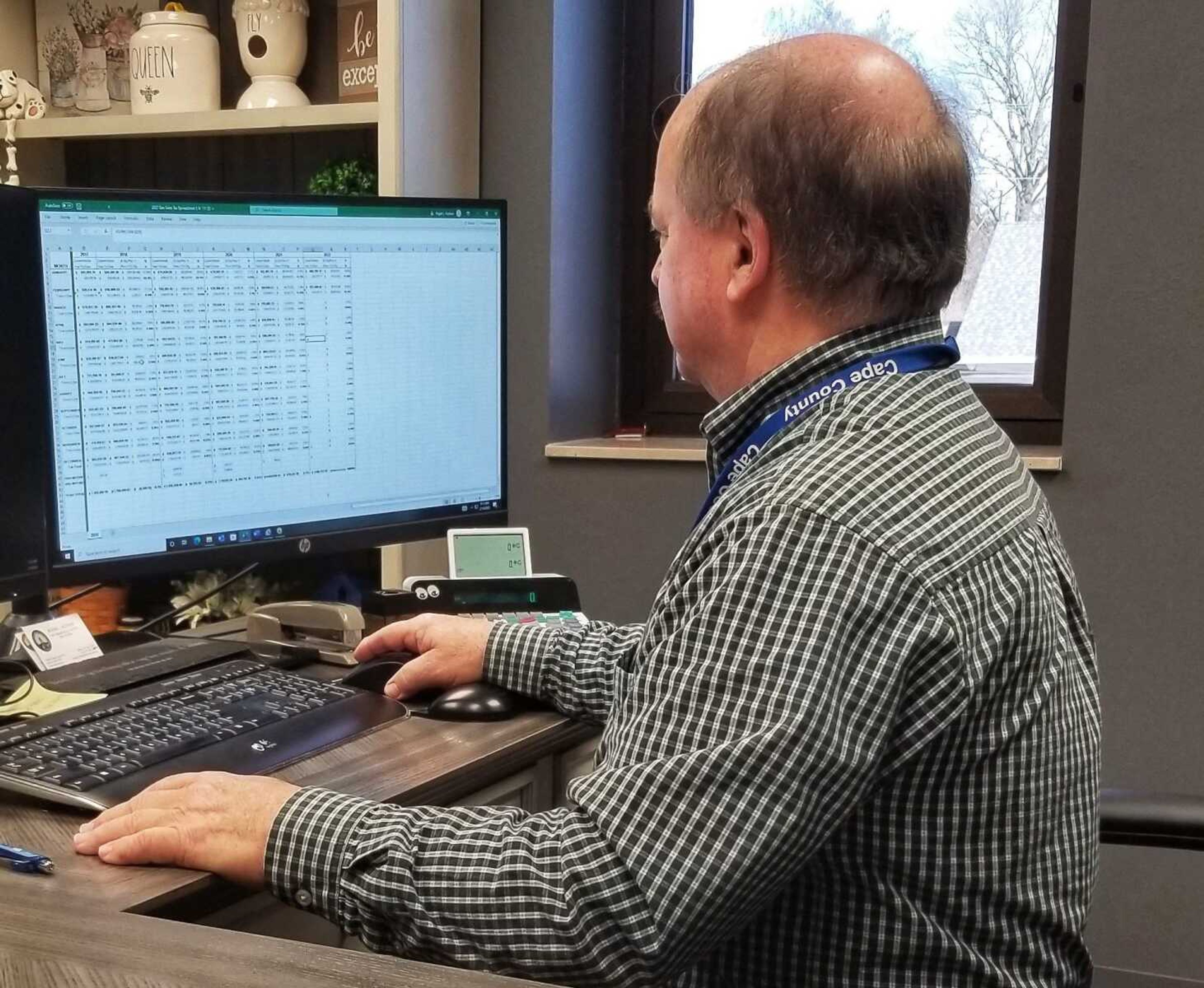

Through the first 10 months of this year, $7,737,917.98 has been collected. To reach last year's final revenue amount, $1,460,821.14 more will be necessary.

If 2022's finish to the calendar year is a reliable indicator, the county may establish a new record since in November and December 2022, $1,555,058.76 cumulatively came into the fund.

During October alone, $762,451.51 was received.

Presiding County Commissioner Clint Tracy, in a text message to the Southeast Missourian, said inflation is "driving" revenue and urged caution in interpreting the numbers.

"Even though general sales tax revenue is up 1.23% (compared to a year ago), it's not keeping pace with inflation and expenses. Wages aren't keeping pace with inflation which will lead to a reduction in spending," Tracy wrote.

"Let's hope this isn't a leading indicator of a recession," he added, noting revenue numbers from cities in the county should also be consulted to do proper analysis.

Other funds

- Use tax: A strong October follows the trend of a markedly improved year for the tax on online and out-of-state sales in the county. Use tax proceeds recorded this month total $293,718.73, a nearly 66% increase over October 2022. For the first 10 months of 2023, $3,171,759.07 has been received, 26% above the collection from January to October a year ago. Use tax proceeds are designated for the county's justice center in Jackson, which opened in 2020.

- Law enforcement sales tax: In October, $762,297.13 was received, bringing the year-to-date figure to $7,719,570.71, a modest 2.2% above the first 10 months of 2022. This levy is earmarked for the county sheriff's office and was first OK'd by county voters in June 2020.

- Proposition One: Approved in 2006, this tax enables funding for county road and bridge improvements. In October, $762,451.67 was received, the weakest single-month performance for the fund this year since $679,935.85 was collected in May. From January through October, Prop 1 proceeds are up 1.2% compared to the same 10-month period in 2022.

Connect with the Southeast Missourian Newsroom:

For corrections to this story or other insights for the editor, click here. To submit a letter to the editor, click here. To learn about the Southeast Missourian’s AI Policy, click here.