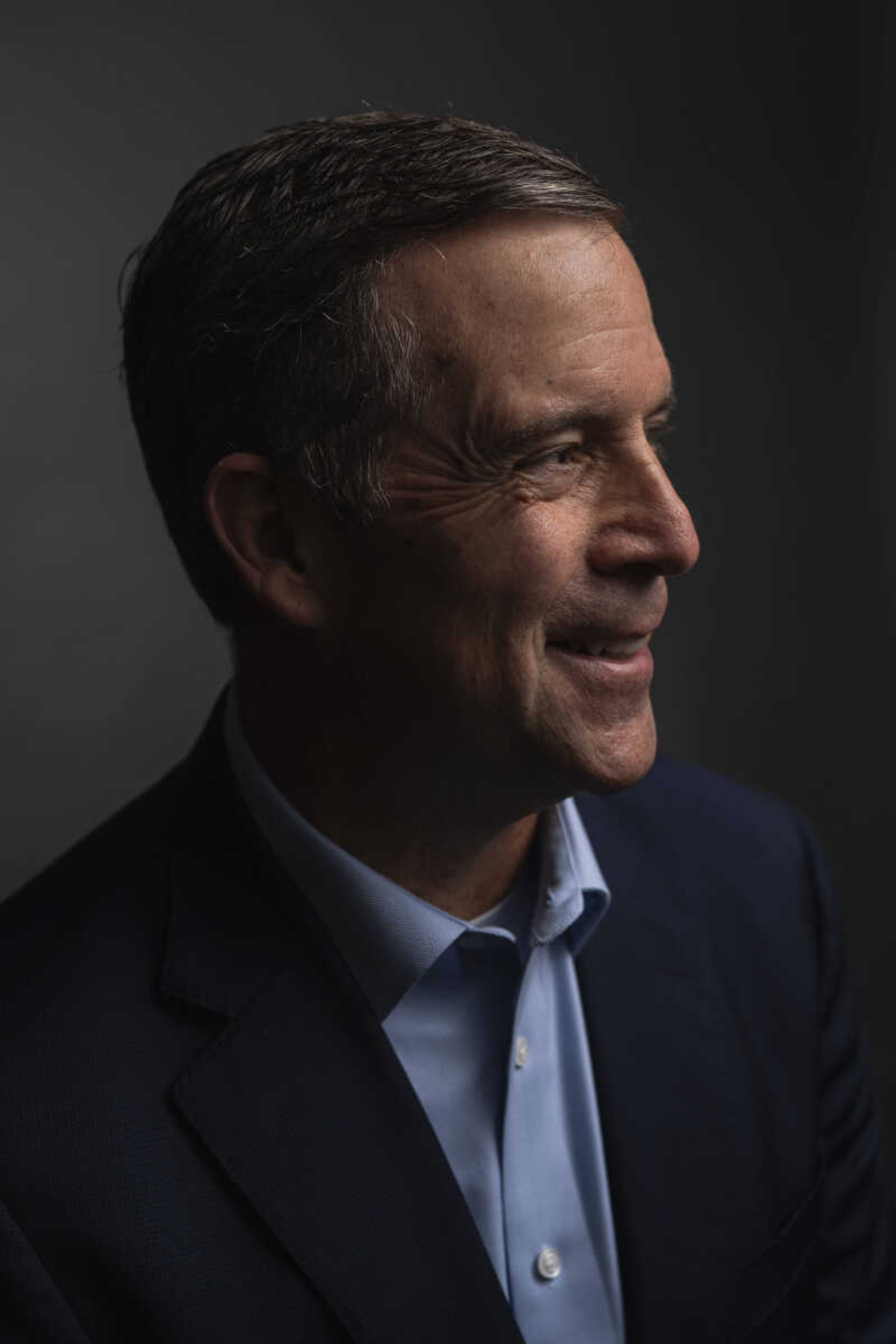

Local banker Adrian Breen talks state of banking, role with Missouri Bankers Association

Adrian Breen is the executive chairman, CEO and president of The Bank of Missouri, a community bank with its corporate headquarters in Perryville, Missouri and locations across the state. Breen, who has been in the banking industry for 36 years, joined The Bank of Missouri in 2017 as the company’s CEO...

Adrian Breen is the executive chairman, CEO and president of The Bank of Missouri, a community bank with its corporate headquarters in Perryville, Missouri and locations across the state. Breen, who has been in the banking industry for 36 years, joined The Bank of Missouri in 2017 as the company’s CEO.

Breen has served on the board of the Missouri Bankers Association for several years. In June, he was named chairman of the Missouri Bankers Association for a one-year term. He will continue to serve on the board as past chairman for the next year when his term as chairman expires this summer.

Breen attended Xavier University and Morehead State University. He played college football, and later signed an NFL contract with the Cincinnati Bengals where he played for the team during the 1987 season.

B Magazine spoke with the banking executive recently about his time as chairman of the Missouri Bankers Association and some of the big topics of conversation in the industry. What follows is a transcript of that conversation, which has been edited for space considerations.

B Magazine: You’ve been chairman of the Missouri Bankers Association since last summer. How does the association support its member banks?

Breen: They do a fantastic job of supporting their member banks. Mostly, they advocate for the banking industry, especially community banks, in Washington, D.C., and Jefferson City.

At the state level, and the federal level, they have educational programs that if you’re a small community bank and you can’t afford to go out and have your own curriculum, they have those programs available. They put on conferences, seminars and training sessions on a wide range of topics to help banks operate more efficiently, but their main mission is advocacy for community banks. We need it now more than ever with everything that’s going on at the federal level but at the state level, too.

B Magazine: As you’re talking with colleagues across the state, what are some of the big industry topics that are coming up?

Regulatory pressure right now. Net interest margin. If you look at the current interest rate environment, that’s the biggest challenge for banks. Deposits. Your net interest margin. You charge a loan back and prime is 3.25% or 3.5%. That’s on the books. Maybe it’s a fixed rate for a couple of years, and we had this unprecedented 500%-525% increase within a year, so everyone’s cost of funds went up 5%. We actually have loans on your books that are being charged less than we’re paying out deposits.

If you’re a mortgage bank, which we (The Bank of Missouri) are not, those are longer-term fixed rates and your margin is going to hurt for as long as the term of that mortgage is out there. And just think when rates were 3% and 3.25% for a 30-year fixed rate mortgage, and someone’s still holding that. Rates are at 5%, prime’s over 8% now. That’s not unique to the banking industry, but the time that it took to get there is unprecedented.

We had an exercise that we used to do for regulators where we do a plus 300, minus 300. What would happen if rates went up 300% quickly or dropped 300%. Basically, 3% can blink of an eye and all the bankers said, “That’ll never happen.” Well, it didn’t. It was 5%. 500% in less than a year. So that creates a lot of challenges. And then we were all flush in liquidity deposits from some of the pandemic programs that came out, the stimulus checks that everybody got. Everybody was in a great place. And then inflation hit, took all that excess cash back, is pulling money in deposits out of the banking system. The Feds deleveraging their balance sheet. You’ve got all these dynamics going on at the same time, which makes it really unprecedented. Inflation is a lot more challenging than unemployment, believe it or not, because if you’re working, and you still can’t pay your bills, it’s no different than not having a job.

B Magazine: I think a lot of people remember last year when you had the high-profile banks that collapsed. Do you see other banks potentially in trouble? How secure are Missouri banks, and what should people be looking for when selecting a bank?

That’s a fundamental flaw when you see a bank go through that. When times are good you can get away with a lot of bad decisions. And then when times change and become more challenging, your policies, procedures and practices get tested. Fortunately for the state of Missouri, I can’t speak for everyone, but the banks that I’ve seen in my MBA (Missouri Bankers Association) tour are in very good shape. They are very good bankers.

Typically in Missouri, they are diversified. No one really had the challenges that a Silicon Valley Bank or a Signature Bank face, and I’m sure that’s been well reviewed and discussed, but just fundamentally, they had a disproportionate amount of their deposits that were not FDIC insured. They were a FinTech bank. I can’t tell you how many years I went to conferences where Silicon Valley Bank had figured it out. They could lend to FinTech’s and not lose money. They picked all the winners; they could do nothing wrong.

While they took all that money when rates were at historic lows, to get a return on it, they went long-term in bonds and maybe municipal securities. They don’t buy stocks. It’s probably typically treasury bills. They went out long, 10 years, I think maybe 15 years, they said, and then they tried to do a capital raise and people said, “Well, no, we don’t like your balance sheet. And not only are we not going to invest in you, we’re going start pulling money out of your bank.” It’s kind of a social media-generated run on the bank.

They had so many depositors that were over the $250,000 FDIC limit, their first reaction was I got to get my cash out of there. If this bank fails, anything over $250,000 is not insured. I think it was in the mid-90% range of their deposit base that was not FDIC-insured.

Most of the banks in Missouri are probably over 50%, 50% to 70% range, I would guess that their deposits are insured by the FDIC.

We participate in the Cedars Program, and a lot of banks in Missouri do. You can come into The Bank of Missouri branch if you’re worried about that. The first thing is titling. If you have an individual account: $250,000. If you’re joint on another account with somebody, that’s $250,000. If you’re dealing with a different person, that’s $250,000. There are some creative things that you can do that can get you up to well above the $250,000 threshold just in your household. But if you go over that, which is very rare, then you can use that Cedars Program that we participate in, which is what they call reciprocal depository relationships. You go to the Cedars Program, and maybe you’re $200,000 over that limit. We send that to a different bank where you have no deposits. That’s now insured, and then they send us a customer from somewhere else to replace that. Your liquidity and your deposit base, your ability to lend and service your community stays the same right there. So that’s the reciprocal part.

B Magazine: One of the challenges I hear about a lot is the sophistication of cybercriminals. How are banks tackling the issue and what do consumers need to know to protect their money?

Well, it’s a two-edged sword because the bank does a lot to protect its customers. I could sit here all day and talk about the firewalls and the different procedures and protocols that are in place. But if someone sends you a text and tells you to click on this link, all that goes away. That is our biggest challenge in banking. Banks have built a moat. They filled it with water and sharks. They put fences up around it. Put that razor wire up there, but we are still subject to human behavior — and especially the elder community. They are more trusting, haven’t kept up with the sophistication and they get that text, and it might look like it says it’s from The Bank of Missouri, or your bank, or Amazon’s a big one out there right now, Apple, where they just duplicated that screen.

If it’s an email or a text, never click on those links. You can call the bank. You can log into your own system, but once you click that they are holding your phone, not actually, but in reality. They have access to all your accounts. And they can move money around and do whatever they want.

But the biggest flaw in this past year was good old check fraud, stealing checks out of the mailbox. We heard stories that the Postal Service had a key stolen, network master keys for the blue mailboxes. And then they were going in there, looking for checks made out for cable bills, mortgage payments, whatever it was. They can dip them in nail polish remover, change the payee, the signature, the amount, everything’s the same. Setup fictitious accounts, flush them through, and then go out and use like a Cash App and different mobile apps to get gift cards and move money around. So as technology evolves, their conduits for fraud multiply.

With generative AI, if you have your voice on your voicemail, and you say, “Hey, I’m not available to take your call right now. Please leave me a message.” They can duplicate a lot more of your dialect and your voice, and they can call into your bank and say, “Please transfer my money to x.” So that’s getting very sophisticated. So banks’ policies, procedures and protections are all just changing by the day.

B Magazine: You talked about regulatory and cyber, what are some of the other challenges that banks face?

As I make my way around the state, succession planning is a big deal for people. There are a lot of family-run banks in Missouri, and they have to have a succession plan. And sometimes a family does want to continue the business so they’re either looking for a merger partner or trying to find talent to come in and take those banks over and have that next generation be ready to run it.

B Magazine: That leads to another question with recruiting. Are you seeing a good number of people still wanting to go into banking? What are the trends?

I think we are. We have employees in 26 different states now, and we’re an ESOP (employee stock ownership plan). At The Bank of Missouri, our largest shareholder is the employees. We promote that a lot. We have a great benefit and retention package for employees. And we try to create a dynamic learning environment where you can continue to grow in your role. You can go and do different things in the bank, and we try to be responsive to that.

We talked about remote work earlier. I’d love to have everybody in the office every day. Get to see everybody. I’m a people person. But due to life demands, family demands, personal situations and preference now, that next generation, they’re demanding to be able to work from home. You can put your head in the sand and say forget about it. We’re not going to do that. Or you can adjust and adapt and try to keep your culture going. It’s going to be a big challenge with remote work, but I think we’ve got a pretty good system set up.

As I go around and see the different banks in Missouri, that succession planning is an important part of what they’re working on.

Technology, trying to keep up with the evolving banking industry. We got this, what I call out-of-industry pressure from Apple, Amazon, Zappos. Name anybody that’s figured it out very well online and that mobile experience from a customer service ordering, returning, availability. Banks are being pulled. Instead of pushing customers that way, our customers are pulling that away. And you’ve got generational gaps that are where your core customers that have been with you for 40-50 years aren’t interested in that, but they’re not going to be there forever. You’ve got to take care of them. And then you’ve got to have your infrastructure prepared for that digital transformation that’s going on. And we’ve been able to, knock on wood, invest in that, but if you’re a smaller community bank, the dollars you need to properly vet that, research it, develop it, and install it, grow it is very challenging.

B Magazine: Do you see in Missouri some of these smaller community banks needing to merge to be able to accommodate that type of environment to handle the tech demands?

It depends. If you put your head in the sand and do nothing, then yes, you’ll probably have to. We say that technology is eroding the moat that geography used to protect community banks from. The most shocking example of that is Rocket Mortgage. The mortgage was a staple community bank product. If we had your mortgage and your direct deposit, you were a customer for life. Well, we took that for granted. Now a company comes in and says, “Hey, you can apply over your phone. We can scan it, and you can give us your login information to verify.” Who would ever be comfortable doing that? Apparently, millions of people are, because if you look around, and we follow those statistics, Rocket Mortgage is typically the largest mortgage lender in a lot of communities. They traded that security and local feel for convenience. “We’ll print your tax returns and your bank statements and your 401k, your savings. We’ll take care of all of that for you. Just do it all online.” So that’s already been eroded, so to speak, and the personal checking account, savings and CDs aren’t far behind. Credit cards are a good example. So that’s what banks should be focusing on right now. And it’s not easy because that technology is evolving and changing so quickly.

B Magazine: You talked about the challenges with deposits and mortgage rates and what we’ve experienced in the last few years. Looking at current market conditions and then projecting forward, what are your thoughts on where we are right now and where we’re headed?

We’re a mess right now, and I don’t want to be an alarmist. I was a finance major. In school, I wasn’t an economist. But fundamentally, if you look at what’s happening the bubble is growing, and it’s going to have to burst. I’m praying for a soft landing. I’m trying to be optimistic. But the more you hear about giveaway programs and the government printing money, the more inflation is going to go up. And rates are not going to come down despite what the media is trying to convince people of until inflation gets control. And the Fed has never wavered on their goal of 2% inflation. It’s been that way for as long as I can remember. Up over 9% for a while. It’s come down to 3%. You watch the stock market, and call them prognosticators, I guess, say, “It went from 3.3% to 3.2%. Inflation has gone away.” Well, that’s the rate that inflation is increasing. That’s not inflation. If you look over the past three years, inflation in different segments of the economy is up over 30%. And that’s the pain people are feeling now.

I try to connect the dots. And if you take a step back and look at the news that comes out individually, no one’s ever really put it together now, but in summary, you’ve got inflation going up. And I think rates are going to stay higher for longer because I don’t see inflation coming down until we get spending under control. And I’m not taking a political slide either way on that. That’s just fundamentally what happens.

Forgiving student loan debt sounds good. Maybe you saved somebody $50 or $100 a month. Well, inflation just went up $300 a month after all of that. So those are the checks and balances. Checks are being written and we’re watching the balances play out. Somebody has to get up there and communicate and say, “Look, here’s what we need to do. There is no free lunch. Whatever we give away comes back in the form of inflation.” If it’s a giveaway or a spend, you’ve got to get that under control first, because if you don’t inflation is just going to keep going. And if you look at what interest rates have done, people’s capabilities to buy a home have dropped because it’s more expensive, and rates are higher. And then you look at the impact of inflation, I think it was 60% of consumers in America were already living paycheck to paycheck. And then now on average, your bills have gone up 1,000 or $1,100 a month. Where does that come from? Buy now, pay later is not a regulated bank experience. They don’t have to follow the same rules a bank does, so they’ve gone that route. Credit card debt is at an all-time high. Rates are record highs for that. Premature distributions and hardship withdrawals from 401K or retirement savings are at an all-time high. You look at that combination, does that make you sleep well at night? It keeps this old banker up.

B Magazine: You talked a little bit earlier about the regulatory challenges. I know you wrote an op-ed back in October regarding Sen. Josh Hawley’s bill that would cap APR on credit card fees. I think one of the arguments was a limited government approach and that government doesn’t solve problems like this. From a banking perspective, why is it bad to put a cap on credit card fees?

We have millions of credit cards issued nationwide with over a dozen different companies and partners that we issue in their name. You’ll see The Bank of Missouri on the back of the card. We have a line of sight to how those algorithms and the approval processes work. Most of what we offer is to near-prime and subprime borrowers, which means a bank typically cannot offer them a credit card because of their credit score, their late payment history, or a combination of different things. People wind up in that situation for different reasons. Life happens, divorces, deaths, family changes, you name it, loss of employment, all those things. People who wind up in that position don’t do it on purpose. Not everybody, some do, some don’t.

When you put a mass-scale program together, because of the higher delinquency and the higher charge-offs, you have to charge a higher rate and higher fees to be able to offer that program. Take the late fees, $32 maybe, and they want to lower that to $8. Well, when they came out and gave late fee guidance or limits before, they did a lot of analytical work behind it to find out where that money was going and what was happening with it. On average, most of the programs we see, the successful ones might make 50 cents a month per card in profit. It’s not a whole lot of money. And that’s with the $30 late charge, the different fees, and the 30% interest rate. All that combined, that’s what they make. You’re going to take $10-$15 or more away from that component. You’re going to move that math behind that model. And the first thing that’s going to happen is we’re going to have to go out to the cards for prime people that are 8%, 9%, 10%, those are going to have to come up because you have to backfill a lot. It’s not as simple as just raising or lowering a fee. That is a complicated formula that’s used to A) fund the operation and B) make a little bit of profit.

If you have a credit card and you have a 700 credit score, and you pay on time, and everything works, why should someone who doesn’t pay on time charge off their credit card and get the same rate that you get, the same fee structure? It’s not as simple as saying, “Look at all that money they’re making.” They’re not making that much money. By the time charge offs and capital for delinquencies and funding their operation. It’s not the gravy train.

And the junk fees that are out there right now from the CFPB. Everything a bank charges for is a junk fee for some reason. We’re not a nonprofit. We have shareholders. We have bills to pay. If you look at the banking industry as a whole, a return on assets of 1%, 1.5% when all the dust clears, is a lot lower than a lot of industries. But for some reason, it’s easy to pick on banks.

If you look at what a mess the government is today, and what they should be focusing on, again, inflation is costing people $1,100 a month and Josh Hawley is going to try and save $8 a month and then directly take away access to credit for the people that need it the most because in addition to raising rates and fees on people that pay on time, they’ll go down their spectrum, and they’ll say the delinquencies, the charge offs, all that negative history, your card is gone now. We’re either freezing it or turning it off. We can’t afford to give you access to credit anymore. Those people aren’t intentionally there, all of them. A lot of them are there because of life events that want a path to come back. Banks are restricted from making those loans because of the safety and soundness requirements.

B Magazine: What’s being talked about regarding ESG (environmental, social, and governance) from a Missouri Bankers Association perspective?

ESG and DEI (diversity, equity and inclusion) are kind of talked about in the same sentence a lot. The bankers in Missouri that I talked to support the concept of it, but not the way it’s being rolled out. To say that a bank shouldn’t lend to somebody who manufactures ammunition or makes guns or doesn’t follow certain social expectations from the current administration, it’s just not what a bank should have to worry about.

We have rules, regulations, policies, practices and procedures that take all of that out of consideration. You come in to apply for a car loan, I can’t ask you those questions. When you have a mortgage, you can for some reason, but you can’t even reference that data. It’s not been properly defined. You talk to 10 different people, you’re going to get 10 different definitions of it. You talk to regulators about it, seems like the publicly traded banks are being pulled into doing more of that. We say, “Look, we try to treat everyone equally.” We are a risk-based business. You come in and apply, we check your income, pull your credit score, and you will either be approved or denied based on the merits of the application. Anything out there that gets beyond that starts to get really challenging for people.

B Magazine: You talked about recruiting earlier. I know The Bank of Missouri has interns. I’m sure other colleagues around the state do. What are you telling young bankers or folks who are looking to get into the field? What is your advice for young professionals as they start on their career path?

We’ve got interns. We’ve got programs. We recruit at campuses. The MBA sponsors and funds a bank-focused curriculum at Mizzou. As a finance major, you take money and banking classes, but you’re really not prepared to be a banker depending on what role you want to play.

I started as a teller. When I was finishing up college, I worked full time and I went to school full time for about a year, year and a half to finish up. I was married, and my wife was expecting our first child back in the day. And that taught me a lot about life. But it also taught me a lot about banking starting as a teller. Then I went from the teller to an assistant manager to a branch manager to a commercial vendor, credit analyst, regional president and then finally president/CEO and chairman at The Bank of Missouri. And some other jobs in between there in banking that opened my eyes to it.

There’s mortgage bankers, there’s investment bankers, there’s big bank bankers, and then there’s community bankers. And when you are a community banker, you have to wear more hats. You have to have a more diverse field of understanding of how things work and how to approve different types of loans. We don’t specialize people like some of the bigger banks do. My son went to Truman State, and that finance curriculum was probably more heavily weighted toward someone who wants to be an investment banker. He’s a commercial banker over at Commerce Bank, outside of Kansas City now. Watching what I went through was like watching what he went through, and he just turned 34. So even 12 years ago, and watching the finance majors that come out today, they’re not really understanding of the difference in the different careers you can have within banking.

If you come out here as a banker, we have hundreds of positions and responsibilities within a bank. You’ve got your branches, you’ve got your commercial lenders and mortgage lenders, operations, call center, HR, accounting, finance, so you have so many different careers in banking that you can follow.

For me, I grew up one of three kids with divorced parents. My mom worked multiple jobs to just get by. We all had to have jobs to get by. Watching that struggle and trying to figure out how can we make this work. Now, how can I help other people has become a passion of mine, and it’s easy. It’s not work for me. We try to find those people who are passionate about helping other people and understand our whole “Live Well, Bank Well” is having a secure financial position is a good way to have a secure financial future and be successful in life.

B Magazine: Banking has changed significantly in your career. As you look 10-20 years down the road, where do you see the banking industry?

Banking is changing now faster year to year than it has. It used to take 10 years to change, and the banking industry will evolve with technology. That’s going to be challenging. It’s going to be very dangerous. Very rewarding if you can figure out how to do it. I have trouble predicting what banking is going to look like in the next two years, to go out 10 years.

I think one or two things will happen. And it’s almost like at the crossroads where the world is right now. Do you want more government inclusion and oversight and visibility into everything you have and do? Or do you want to have a healthy balance and stay traditionally where we have been with the oversight and the guidance and not the control and manipulation? One of two paths is going to happen here.

I hate to put it all on the development of the central bank digital currency, but that will be one of the deciding factors. Which course banking will take? Because if we go the central bank digital currency route, you won’t need thousands of banks in the country. You’ll have a handful of banks, and that will be a disaster, especially in Missouri, those smaller communities. It will flip the entire model of banking if that central bank digital currency is allowed to take hold.

I think everybody just needs to take a step back and say, “Wait a minute. What kind of country do we want to be?” We have the strongest and best financial system in the world. Everybody understands that. Why would we try to change it and centralize it and give fewer people more control over that? And you heard it in the too big to fail that came out after Silicon Valley Bank and Signature Bank after they failed. We don’t want to replicate that. Diversification in the industry. More banks, not fewer banks are better. And already the capital requirements for the big banks, we have to have more capital as a percentage than they do. And if you grow that big, that fast, I’m not allowed to grow that big that fast without capital. I have to always consider a capital position, my liquidity position. And that limits you from growing. You don’t change the rules and then all of a sudden say, “Hey, these few banks are too big to fail. So we’re going to fold everybody else in, give them more power and more control.”

We’ve got to do our part for the consumers and for our communities. Our whole strategy is we’re not going to replace people with technology. We’re not going to have all people and no technology. We’re going to have the right combination of people and technology. You can access your money whenever you want to. We’ve got to adapt, change our work schedules, change how we deliver it, keep up with those expectations to stay competitive.

B Magazine: How does Missouri stack up from a regulatory perspective compared to other states?

In my opinion, Missouri is very unique. We have the Division of Finance and we’re FDIC and the Division of Finance. The division is in every year. They kind of piggyback every other year with the FDIC. We are incredibly fortunate in the state of Missouri to have the people in the Division of Finance, the bank regulatory group, that we do. They are very skilled, very talented, but they are being challenged to keep those good people coming in. And if you look at one of the things we’re trying to adjust there is insurance and banking under the division. Their pay scales are the same, and a lot of employees at the division get plucked out to go to the FDIC or will work in other industries because their pay scales are limited. It’s good. It’s fair in the state of Missouri, but it’s not keeping pace with the federal regulatory agencies and other employment opportunities that are out there. If we’re not careful, if we don’t get to the governor and convince him that you either need to bifurcate those groups or update both pay scales but certainly those examiners, what you are penny wise will be pound foolish long term if the health and oversight of the state banks are not maintained.

I don’t think there’s a single Missouri bank that’s in trouble right now that has any consent orders or any financial difficulty right now. It was right around 200, a little over 200 in Missouri. Our whole district maybe has one or two banks that are a 1- or 2-rated bank or on sound financial footing right now. All those challenges we talked about, they typically hit on the coasts and the bigger metropolitan areas and dwindle their way down into Missouri communities. But I think most of the banks I’ve seen in Missouri are in pretty good shape.

Connect with the Southeast Missourian Newsroom:

For corrections to this story or other insights for the editor, click here. To submit a letter to the editor, click here. To learn about the Southeast Missourian’s AI Policy, click here.