Answering questions about the case for use tax

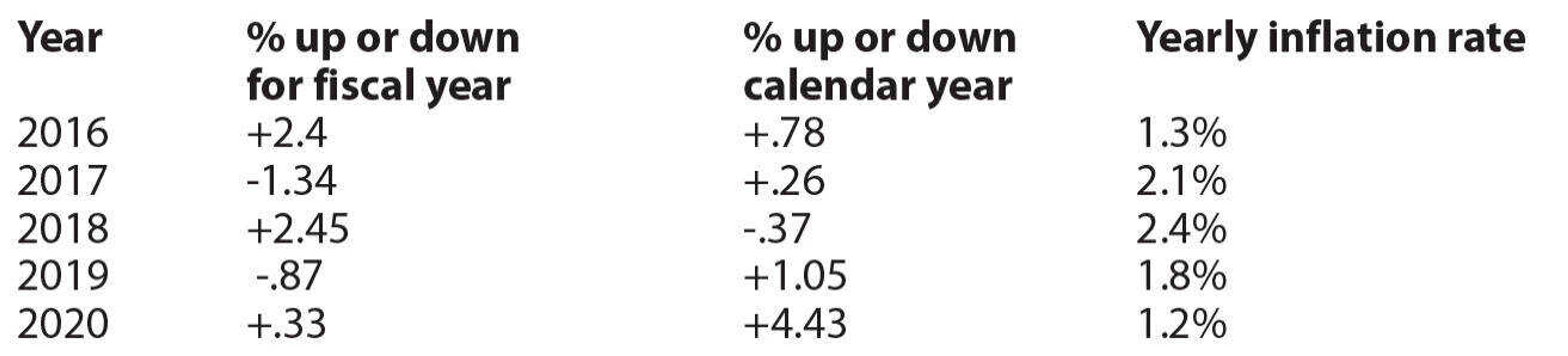

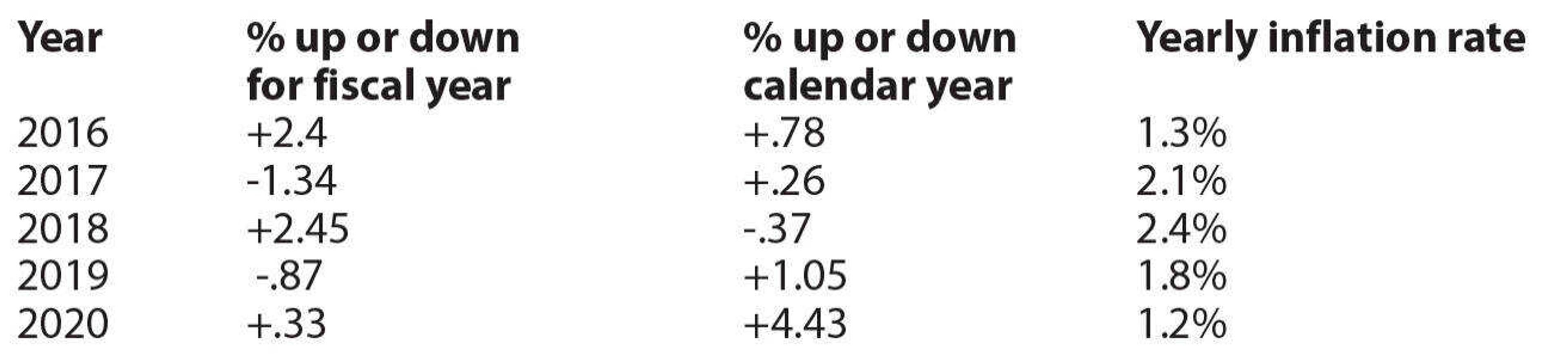

It has come to my attention that throughout this whole process of presenting the facts for the city's financial information in regards to the use tax proposal, there are questions concerning the city's current revenue numbers. Our latest figures presented were through the end of fiscal year of 2019. I will give you the actual revenue figures in the chart nearby both for our fiscal year (June-June) and by calendar year and show the inflation rate for each year...

It has come to my attention that throughout this whole process of presenting the facts for the city's financial information in regards to the use tax proposal, there are questions concerning the city's current revenue numbers. Our latest figures presented were through the end of fiscal year of 2019. I will give you the actual revenue figures in the chart nearby both for our fiscal year (June-June) and by calendar year and show the inflation rate for each year.

You can see that through the second half of 2020 sales tax revenue picked up considerably over previous years. Through the first 10 months of 2021 sales tax receipts are up 9.2%. But inflation for the year 2021 is projected to be over 5%. Please note that these figures are for the general revenue fund only and figures for 2021 are unaudited. I apologize that these latest revenue figures were not included in presentations. Myself and others do not expect these higher sales tax revenues to continue, and I'll explain why.

There has been an obvious government stimulus impact on sales tax revenue in our city. In 2020, the stimulus impact (assuming 50% spent on goods) was $510,489. In 2021, so far the stimulus impact is $1,031,243. This is simply from the three federal stimulus payments in May 2020, December 2020 and March 2021. This does not include enhanced unemployment benefits or PPE loans. We do not expect this anomaly of increased sales tax revenue to continue. As online sales continue to climb, our revenues will most likely revert to where they were before, below the rate of increasing expenses and the rate of inflation.

I hope these facts will clarify our current revenue situation and solidify why the passage of the use tax proposal on Nov. 2 was so important. It is vital for the future of our city and its most important attribute, our employees.

But to set the issue straight, I have not hid the fact that sales tax collected the last year or so is up considerably. It has bolstered each specific sales tax for capital improvements, parks and recreation/stormwater, etc. And I have also said publicly that some of the additional revenue in our general fund may allow us to help employees even before the use tax goes into effect in 2023. Like many areas across the country, we have benefited from all of the federal dollars given away. I can assure you that council will continue to invest your tax dollars wisely and will be sure to explain how use tax receipts are spent once they begin to be collected in 2023. We will have a specific plan which will delineate how we intend to capitalize on the increased sales tax revenue to help our employees. We hope to announce this plan before the end of this year. So stay tuned.

Bob Fox is the mayor of Cape Girardeau.

Connect with the Southeast Missourian Newsroom:

For corrections to this story or other insights for the editor, click here. To submit a letter to the editor, click here. To learn about the Southeast Missourian’s AI Policy, click here.