Tax lists for a given locality are often unavailable for every year (one exception being Virginia). Courthouse disasters, poor storage and intentional discarding all resulted in these losses. Accordingly, we often have a fragmentary picture of an ancestor if we rely only on tax lists.

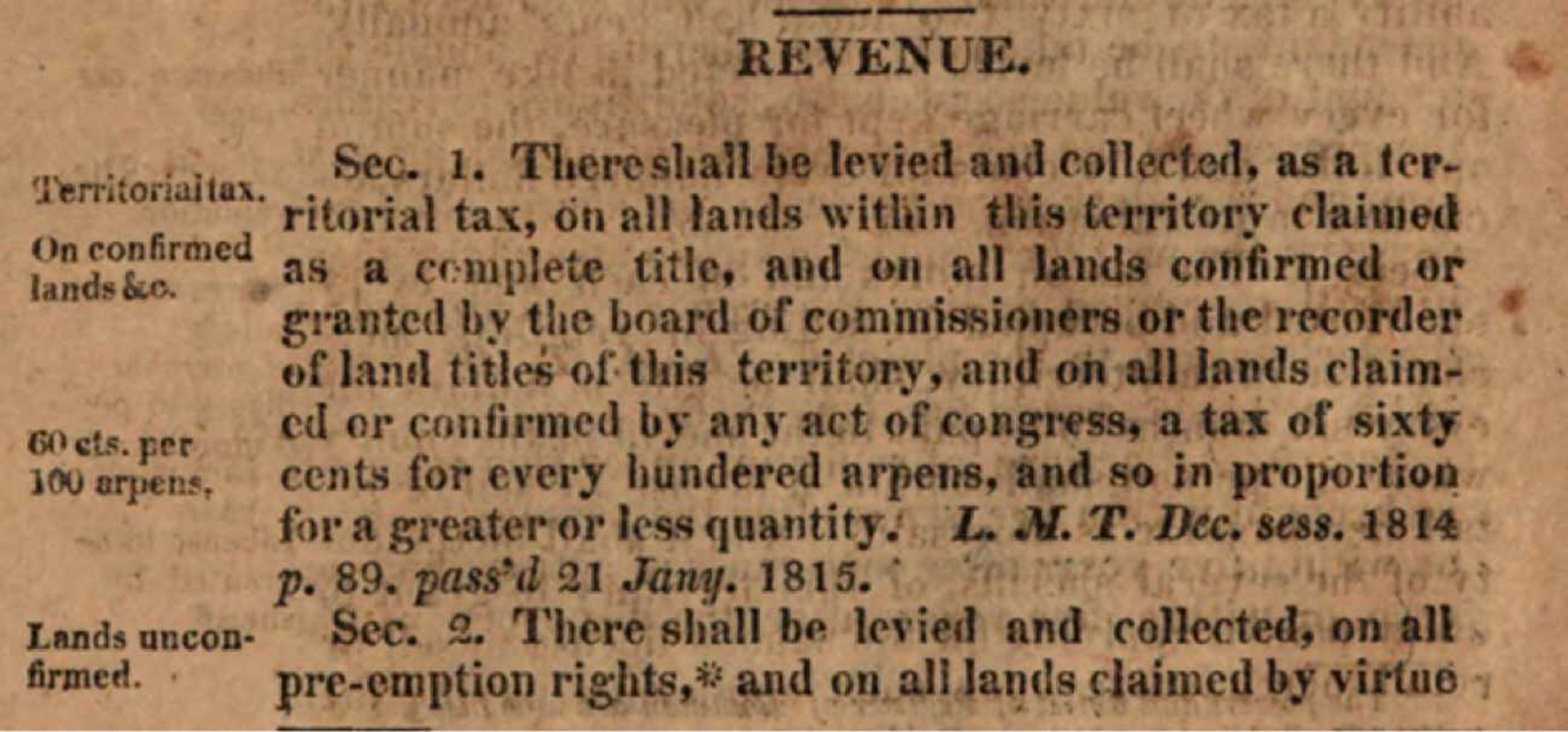

The first step in using tax lists effectively is knowing the law, which includes the process, items taxed and tax rates for the year(s) your ancestor paid taxes. Statutes and legislation are available for most states through state archives; book scanning services such as Google Books, Internet Archive and Hathitrust, or state libraries. Keep in mind that collectors copied tax assessments -- depending on the state -- collectors sent these copies to the state capital, retained in different county offices or used as a basis for the next year's assessment list. You have few clues whether you are viewing the original or a copy.

Once you have found the person on a tax list, copy or abstract everything. Examine the first page of the list, which often is the only page with column headings. You will need these to interpret subsequent pages. Record the page number, township or district, items taxed and valuation, and the amount of tax -- or photograph or download the page. If the list is unpaginated, count the pages and record a number in brackets. If the assessor recorded the list in visit order (not alphabetically), record at least 10 neighbors before and after your ancestor. They may be relatives or associates. Check tax lists for all years available in the period of interest.

Finding tax lists can be a challenge. They may be in the county courthouse or archive center (in counties that have one). Often states required that counties send lists to the state capital and originals and/or microfilm may be in the state archives or library. You can locate transcribed lists online by using a search engine and searching for " tax list." Deed books contain some lists, usually delinquents.

Genealogists have transcribed or abstracted tax lists in book form for some localities. These are in libraries or might be available for sale, but be cautious and use them to facilitate accessing original documents. Some counties have freed space in the courthouse by loaning tax lists to local historical societies, so check in advance of a visit.

Images of some tax lists are accessible on Ancestry (or other subscription services). Search for these on Ancestry using "Search" then "Card Catalog" then "tax list " in the title and key word boxes. Be sure to read the summary information for the individual database so you understand what you are viewing.

FamilySearch provides access to an even larger number of images through the Catalog. Use of FamilySearch requires that you have a free account and log in. Search for the locality of interest in the catalog. Then, scroll down the list of records to "Taxation." You need to search page-by-page for most locales, so be sure to record film and image numbers.

Researchers using tax lists should also use delinquent tax lists; that is, lists of those who failed to pay assessed taxes. First, ask why your ancestor failed to pay -- insolvency, moving elsewhere, traveling or death. This stimulates research in other records. Newspapers published delinquent tax lists (which may provide some records for counties with record loss), so newspaper searches are useful. Deed books include some lists of delinquents, especially if the state sold the property to pay the taxes. The first penalty in many states was a fine double the amount of tax. Then, the threat of land sale and the actual sale to pay the tax. Nonetheless, landowners could still redeem land within a set period, depending on provisions of tax law.

A good strategy for finding an individual in tax lists in most areas starts with searching other records first (such as census, probate, vital records and land). Then, study the tax laws of the locale for the time. Check county boundaries to ensure you are searching in the correct place and use maps to find water courses for land descriptions in early lists. Then check for availability of transcriptions of tax lists -- transcriptions make finding originals easy. Locate the tax records and search the complete list. Then, check adjacent jurisdictions if you are unable to find your ancestor.

Connect with the Southeast Missourian Newsroom:

For corrections to this story or other insights for the editor, click here. To submit a letter to the editor, click here. To learn about the Southeast Missourian’s AI Policy, click here.